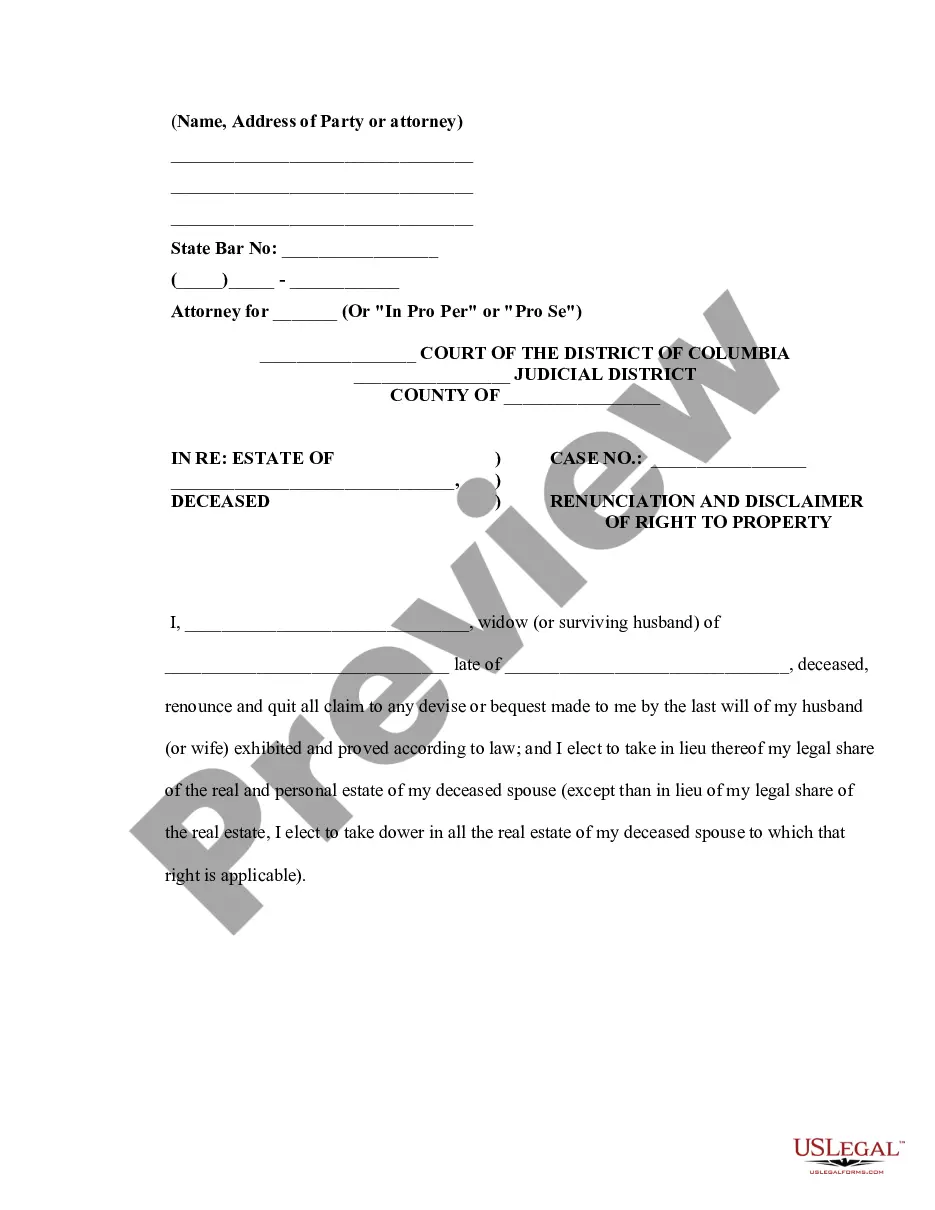

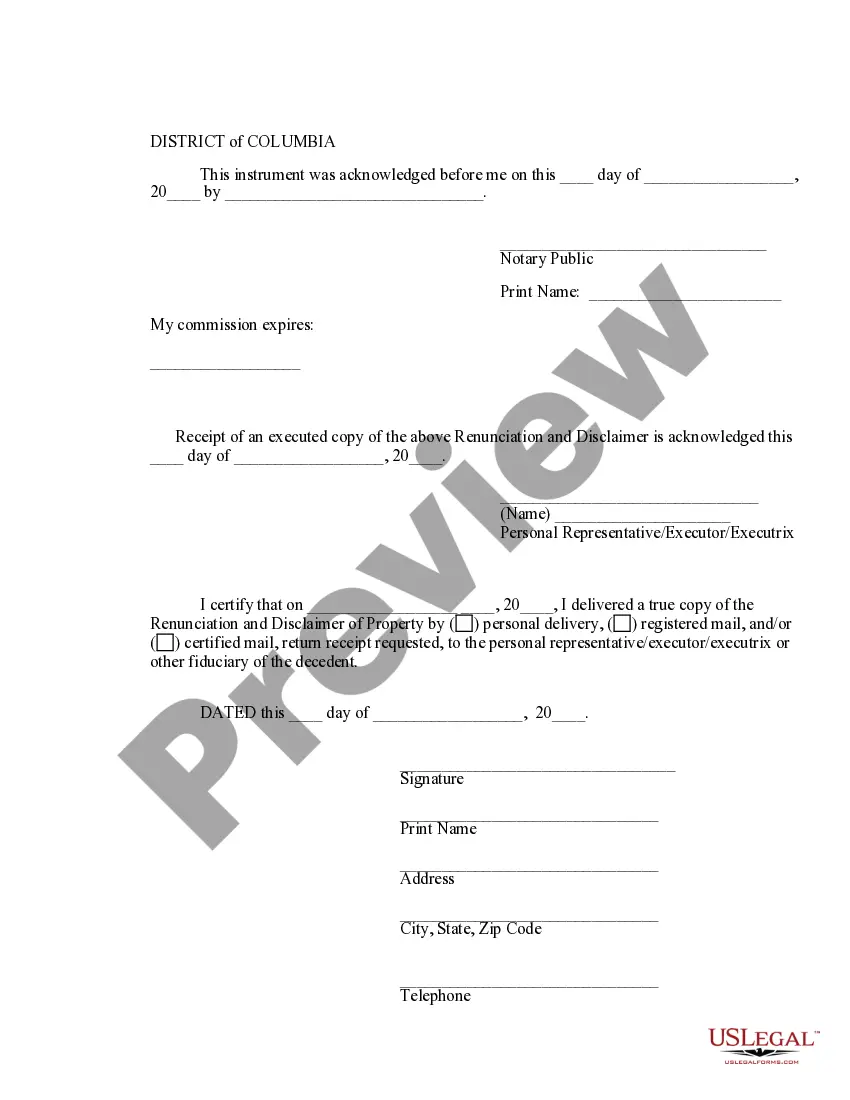

This form is a Renunciation and Disclaimer of Property acquired by a widow/widower due to the death of her/his spouse. The surviving spouse elects to take dower in all the real estate of her/his deceased spouse in lieu of her/his legal share of the real estate and personal estate of the deceased spouse. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Property Disclaimer Examples

Description

How to fill out District Of Columbia Renunciation And Disclaimer Of Property From Will By Testate?

The more papers you need to create - the more nervous you get. You can get thousands of District of Columbia Renunciation And Disclaimer of Property from Will by Testate templates on the web, however, you don't know which of them to have confidence in. Eliminate the hassle to make getting samples more straightforward employing US Legal Forms. Get accurately drafted forms that are created to satisfy state specifications.

If you already possess a US Legal Forms subscription, log in to the profile, and you'll find the Download button on the District of Columbia Renunciation And Disclaimer of Property from Will by Testate’s page.

If you’ve never used our platform earlier, finish the sign up procedure using these instructions:

- Ensure the District of Columbia Renunciation And Disclaimer of Property from Will by Testate is valid in the state you live.

- Re-check your selection by reading the description or by using the Preview functionality if they’re provided for the selected file.

- Click Buy Now to start the signing up process and select a pricing program that meets your preferences.

- Provide the asked for data to create your account and pay for the order with your PayPal or credit card.

- Choose a hassle-free file type and obtain your duplicate.

Find every file you download in the My Forms menu. Simply go there to produce a fresh copy of the District of Columbia Renunciation And Disclaimer of Property from Will by Testate. Even when using professionally drafted templates, it’s still important that you think about asking the local attorney to double-check filled in form to make certain that your record is accurately completed. Do more for less with US Legal Forms!