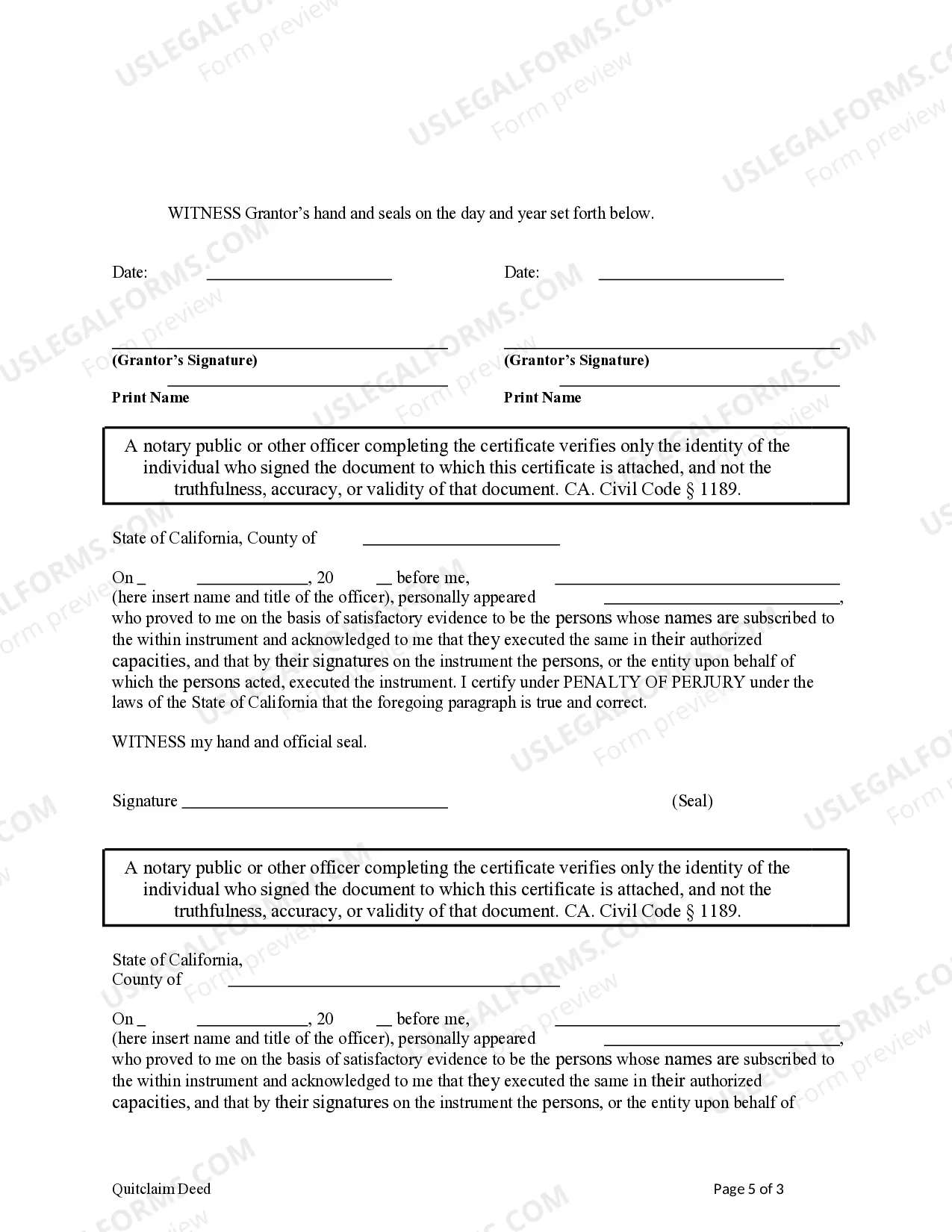

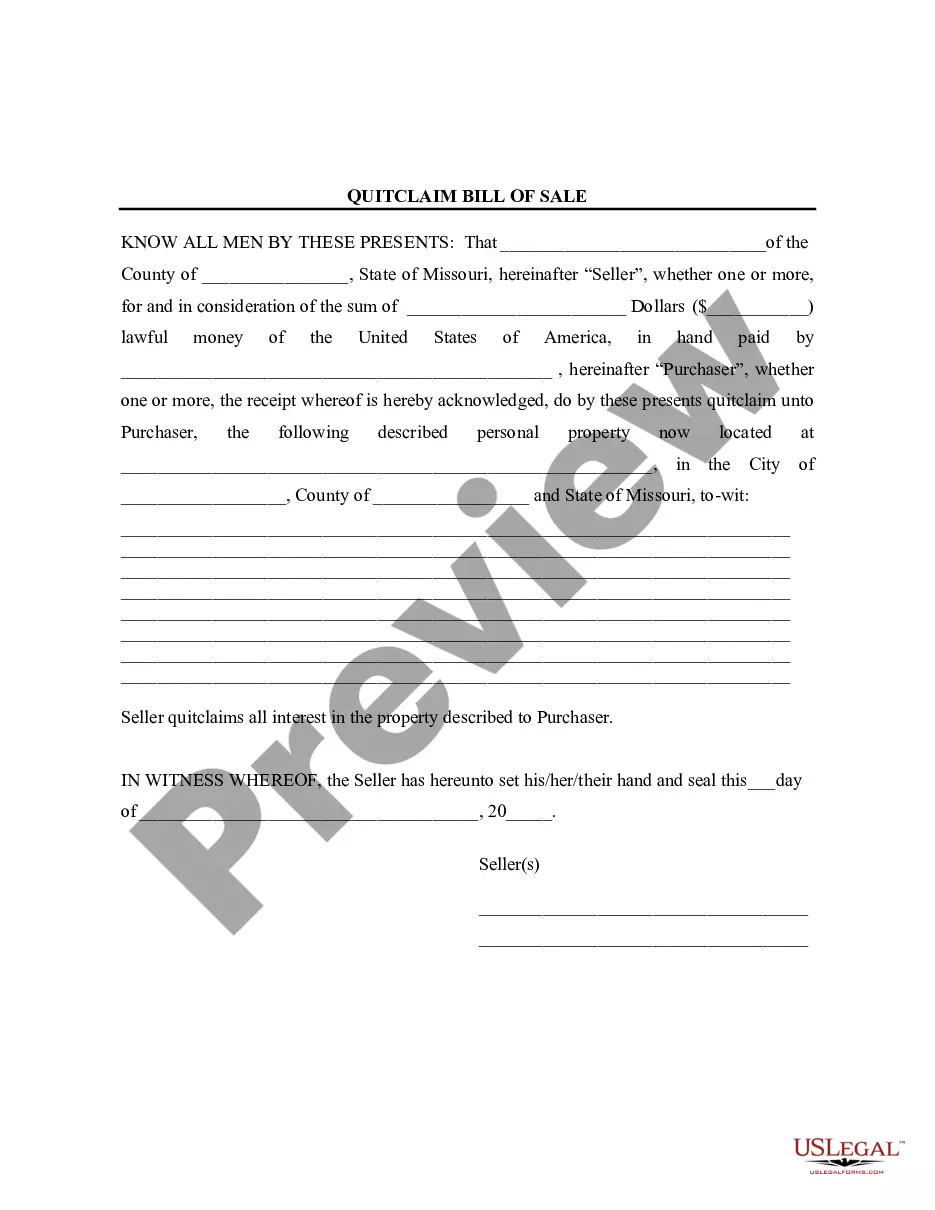

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantees are two married couples. This deed complies with all state statutory laws.

California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples)

Description

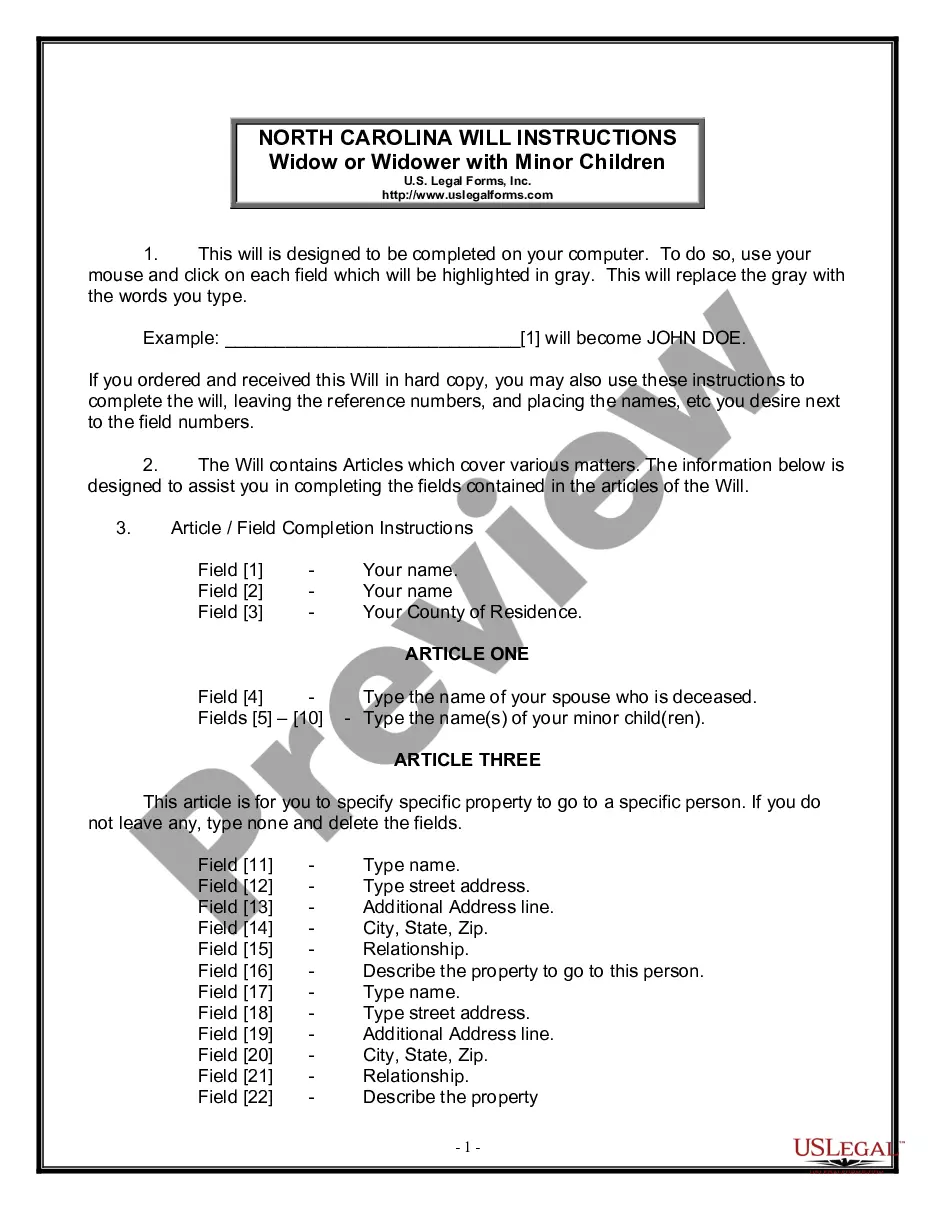

How to fill out California Quitclaim Deed From Husband And Wife To Husband And Wife And Husband And Wife (Two Couples)?

If you're looking for precise California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) documents, US Legal Forms is exactly what you require; find templates created and validated by state-authorized attorneys.

Using US Legal Forms not only alleviates your concerns about legal paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional template is far more economical than hiring an attorney to do it for you.

And that’s all! In just a few straightforward steps, you obtain an editable California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples). Once you create an account, all subsequent orders will be processed even more easily. With a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form’s page. Whenever you wish to use this template again, you will always be able to locate it in the My documents section. Do not waste your time sifting through various forms on multiple sites. Acquire professional templates from a single trusted source!

- Begin by registering with your email and creating a password.

- Follow the provided instructions to establish your account and obtain the California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) template to address your situation.

- Use the Preview feature or review the file details (if available) to ensure that the template meets your needs.

- Check its eligibility in your state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Set up an account and complete the payment using your credit card or PayPal.

- Choose a suitable format and download the document.

Form popularity

FAQ

In California, it is often advisable for both spouses to be on the house title, particularly to protect each party's interests. Using a California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) can help clarify ownership and facilitate future transactions. Including both spouses minimizes potential disputes in case of a sale or transfer of the property, thereby benefiting both parties.

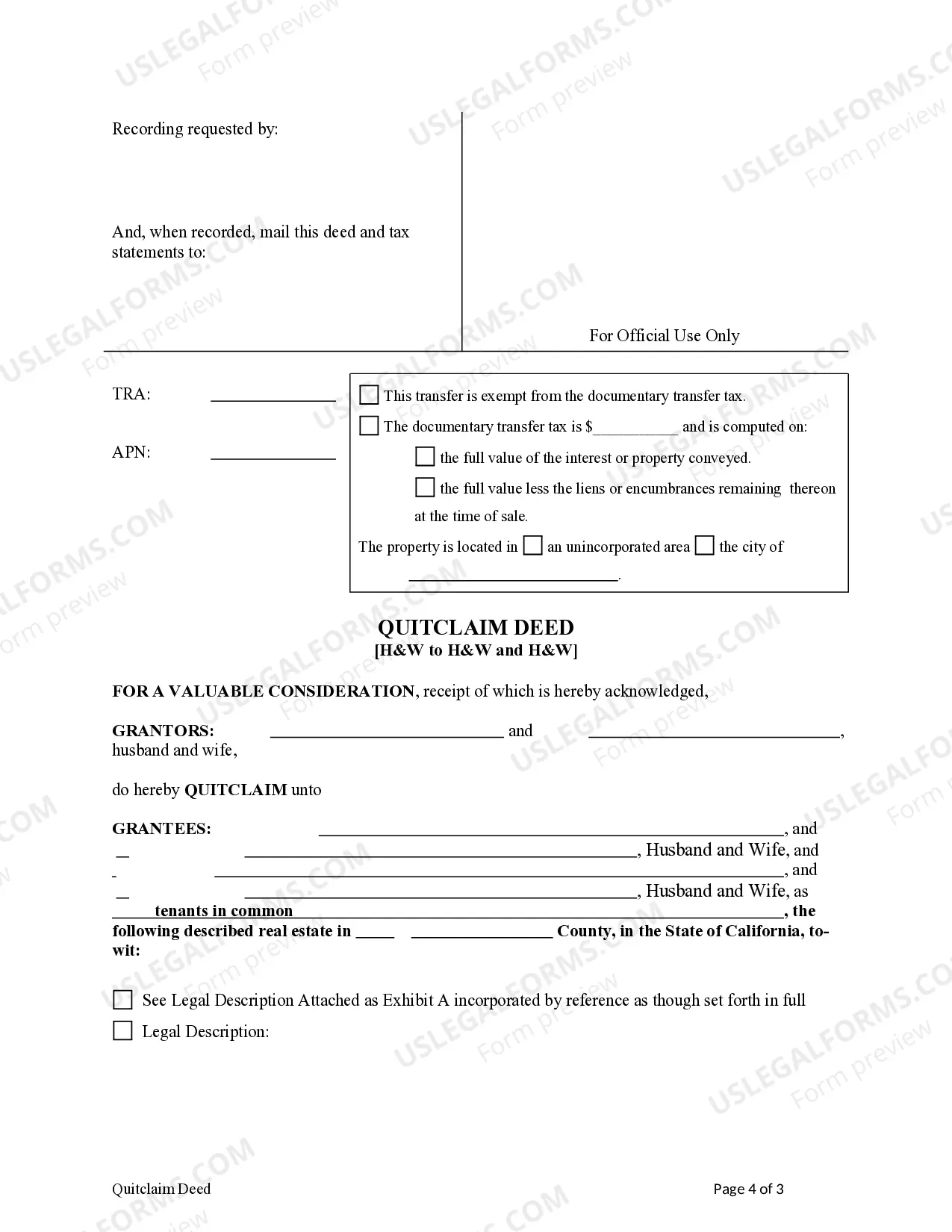

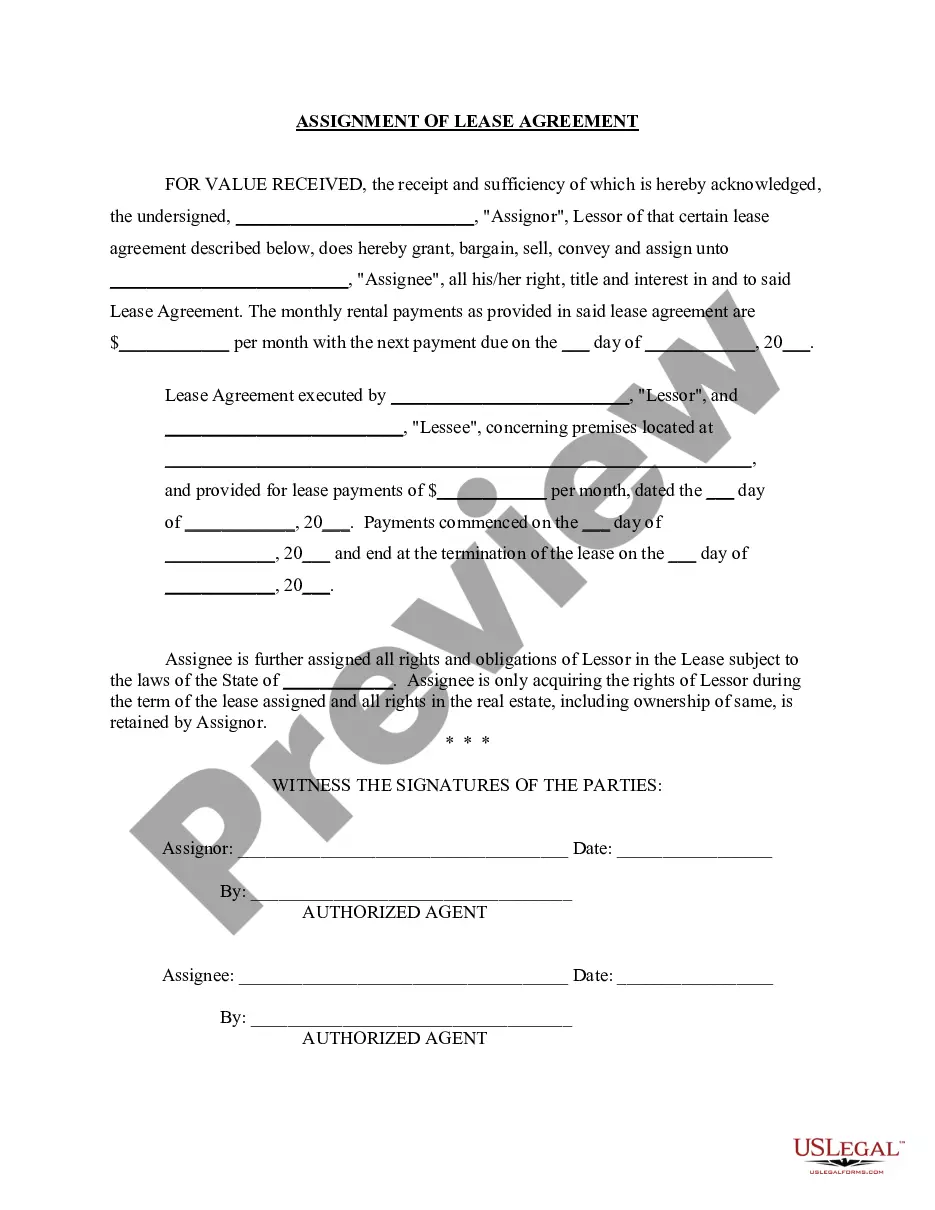

The process of transferring ownership typically involves preparing a deed, signing it, and filing it with the county recorder's office. A California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) serves as a clear mechanism for transferring ownership without formal promises. It is essential to include relevant details and ensure all parties involved understand the implications of this transfer.

One of the most common ways to transfer ownership is through a deed, specifically a quitclaim deed. This is often used in situations involving family members, such as a California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples). This deed allows the transfer of interest in property without additional aspects of ownership disputes, making it a straightforward option.

Yes, you can transfer shares from husband to wife, and this transfer can be done through a stock transfer form. In some cases, a California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) may be relevant when discussing shared assets or community property. It's advisable to consult with a financial advisor or attorney to navigate the legalities of such transfers.

Transferring property from husband to wife after death involves specific legal processes. Although this situation is typically managed through a will or estate plan, a California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) can also facilitate property transfers effectively. You can use platforms like uslegalforms, which offer templates and guidance to complete this process online, ensuring compliance with local regulations.

An Interspousal transfer deed in California serves as a legal way for married couples to transfer property between themselves. This deed often simplifies the transfer process and may have tax advantages, as it usually does not involve reassessing property taxes. For couples managing ownership transfers, this conveys a clear and secure way to handle real estate, especially when combined with options like the California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples).

Yes, a quitclaim deed can give you ownership of a property in California, but it only transfers the interest that the grantor has in that property. Therefore, if the grantor owns a part of the property, you will receive that portion, but the deed makes no guarantees about the title. It is vital to consider whether the previous owner fully owns the property before accepting a California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples).

In California, the California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) is a widely used tool for property transfer. It allows one party to transfer their interest in a property to another without making any warranties. This deed is especially popular among couples or two couples, as it simplifies the process of handling ownership. Choosing the right deed can ensure a smooth transfer and minimize potential disputes.

The California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) serves as a straightforward tool for transferring property. In contrast, an interspousal transfer deed specifically facilitates the transfer of property between spouses, often without tax implications. While both documents execute property transfers, interspousal deeds are designed primarily for marital property situations. Choosing the right deed depends on your specific needs, and uslegalforms can assist you in making the best choice.

A California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) benefits those seeking to simplify property ownership among couples. Typically, spouses use this deed to transfer property without complicated legal processes. For instance, when one spouse wishes to gift property to the other or when couples want to ensure that both parties hold equal interest. This deed allows couples to manage their properties comfortably and effectively.