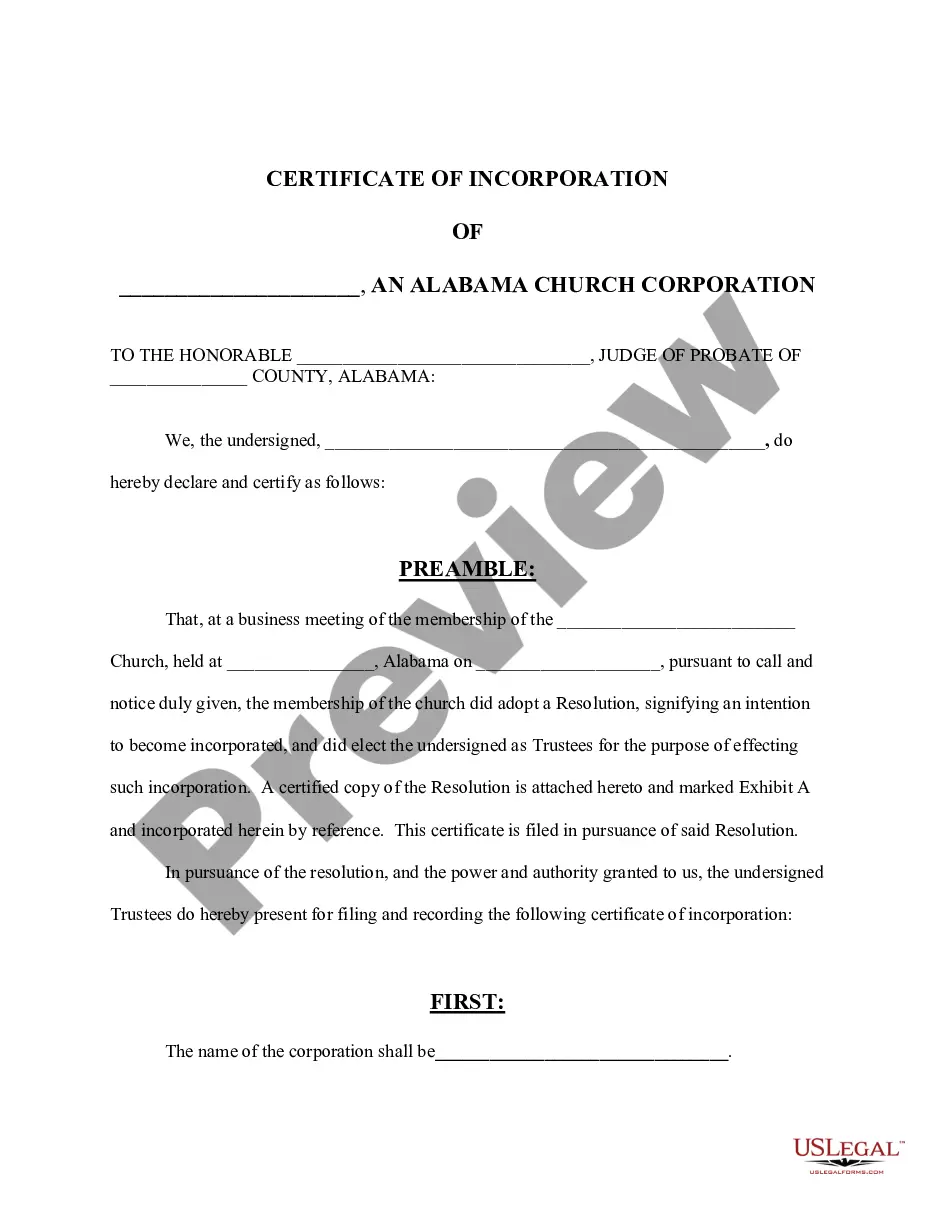

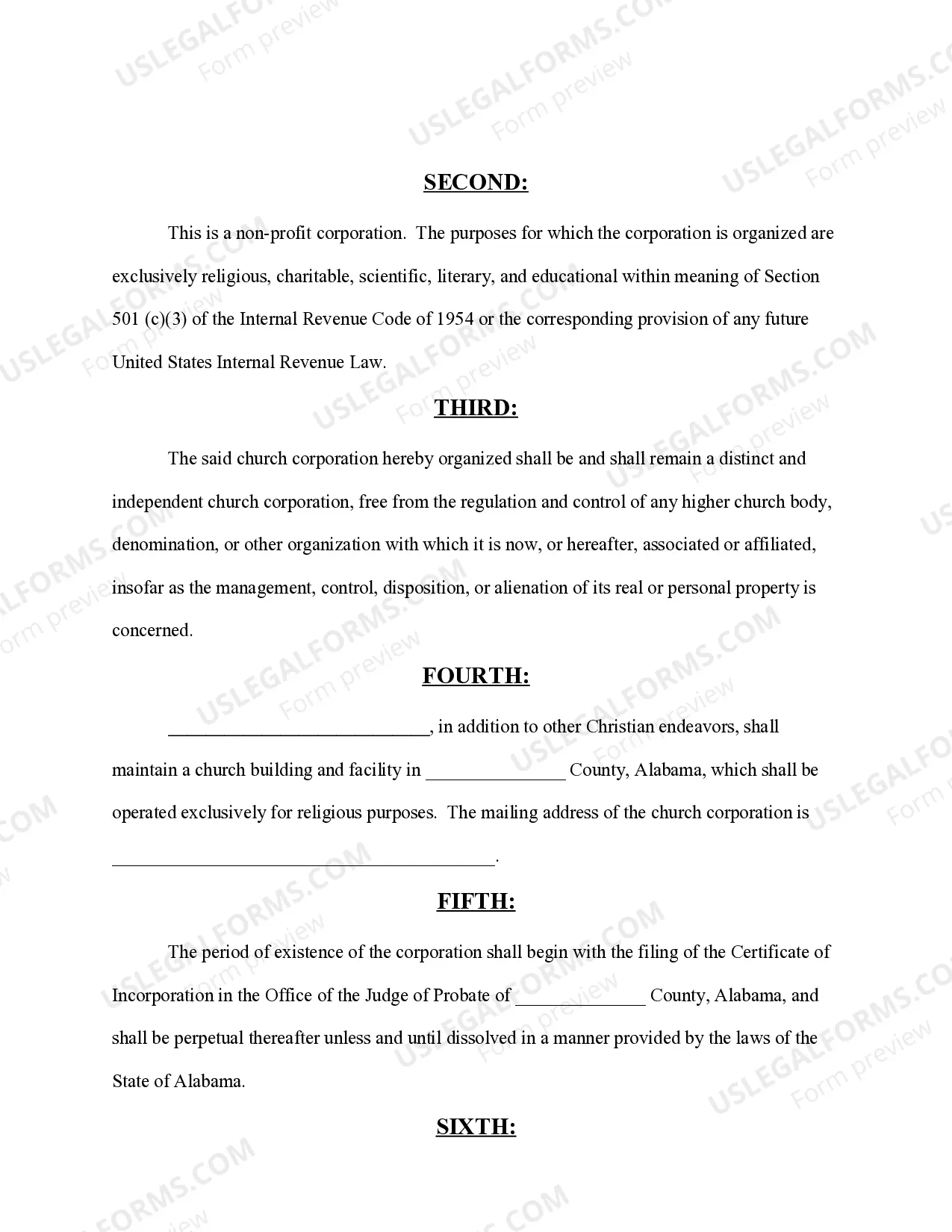

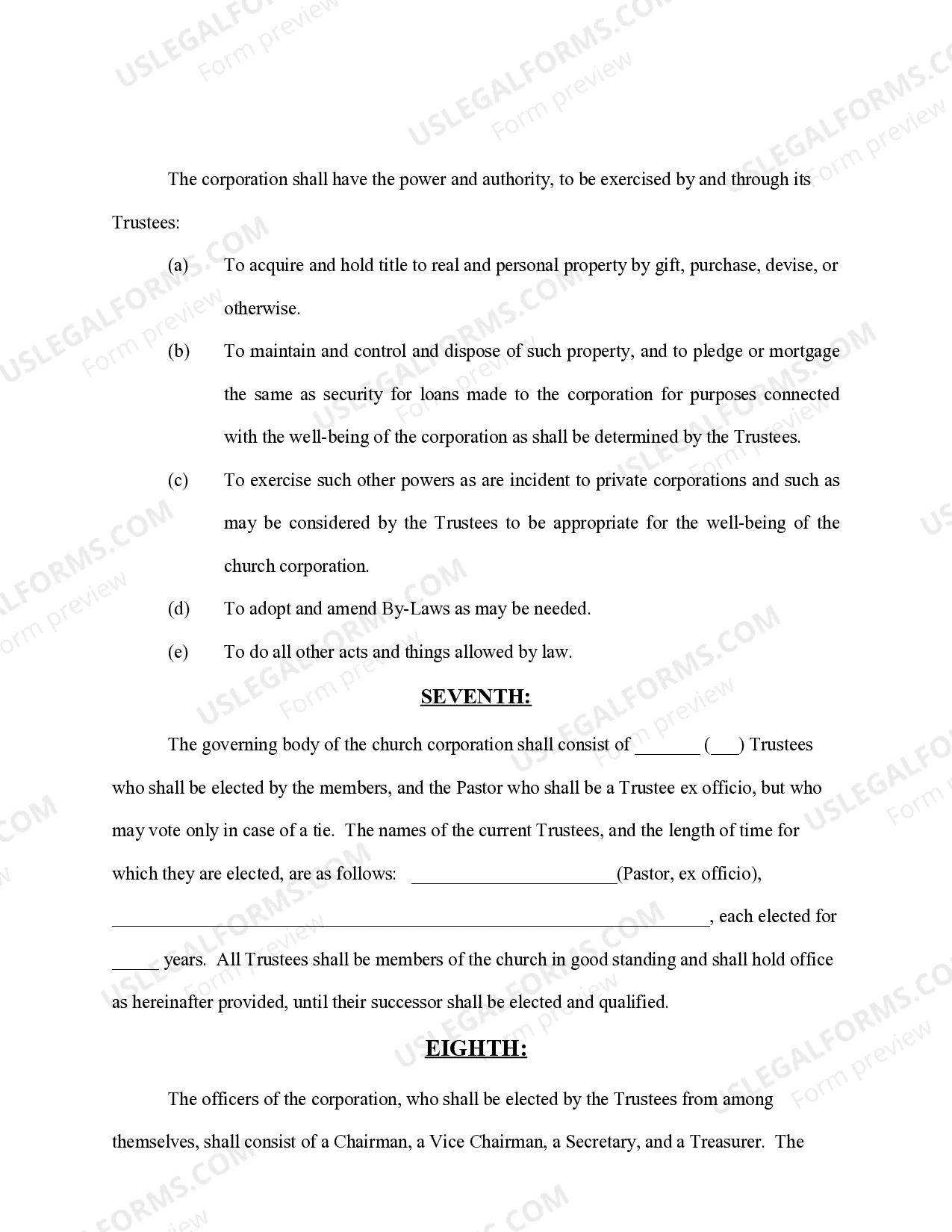

This form is a certificate of incorporation for a Alabama Church Corporation (non-profit). The form is available in both word and word perfect formats.

Articles Of Incorporation For A Church

Description Certificate Of Formation Alabama

How to fill out Incorporating A Church In Alabama?

Making use of Alabama Certificate of Incorporation For Church samples made by expert attorneys enables you to stay away from headaches when filling out documents. Simply save the example from our website, fill it out, and ask an attorney to examine it. Doing this, will save you significantly more time and costs than requesting a lawyer to prepare a file from the blank page for you would.

If you have a US Legal Forms subscription, just log in to your account and go back to the form web page. Find the Download button near the template you are looking over. Right after downloading a document, you can find all of your saved examples in the My Forms tab.

When you have no subscription, that's not a problem. Just follow the guide below to sign up for an account online, get, and fill out your Alabama Certificate of Incorporation For Church template:

- Double-check and ensure that you’re downloading the appropriate state-specific form.

- Make use of the Preview feature and read the description (if available) to know if you need this specific example and if you do, click Buy Now.

- Find another template using the Search field if required.

- Select a subscription that meets your requirements.

- Get started using your bank card or PayPal.

- Choose a file format and download your document.

Soon after you have executed all of the actions above, you'll have the capacity to complete, print, and sign the Alabama Certificate of Incorporation For Church template. Don't forget to recheck all inserted info for correctness before submitting it or mailing it out. Reduce the time you spend on completing documents with US Legal Forms!