Broward County, located in southern Florida, follows specific protocols and regulations when it comes to measurement representations, proportionate share adjustment of tenants, and proportionate tax share. These practices play a crucial role in ensuring fair distribution of taxes and responsibilities among tenants within the county. Measurement representations refer to the accurate and standardized measurement of rental spaces or properties within Broward County. This is essential for determining the proportionate share of a tenant's occupancy in a larger building or complex. Proper measurement representations assist in establishing fair rent amounts, lease agreements, and property valuations. Proportionate share adjustment of tenants refers to the process of adjusting each tenant's share of property expenses based on their occupancy percentage. In shared spaces, tenants pay a proportional amount towards common expenses such as maintenance, utilities, and insurance. The adjustment ensures that tenants contribute fairly and equitably, based on the size of their rented area in relation to the entire property. Proportionate tax share refers to the allocation of property taxes among tenants or occupants. Broward County determines the tax burden for each tenant by considering their proportionate share of the property's value or occupied area. This ensures that property taxes are distributed fairly, without burdening anyone tenant more than others. Proportionate tax share calculations are essential for accurate tax payments and compliance with local tax regulations. Different types of Broward Florida Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share can include commercial properties, residential buildings, retail spaces, offices, and industrial complexes. Each type of property may have its own set of guidelines and calculations based on local laws, lease agreements, and specific property characteristics. It is crucial for tenants, property owners, and real estate professionals in Broward County to understand and comply with these measurement representations and proportionate share adjustment practices. By adhering to these guidelines, tenants and property owners can ensure fairness in expenses and taxes, avoid disputes, and maintain a harmonious landlord-tenant relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Representaciones de Medición y Ajuste de la Parte Proporcional de los Inquilinos Participación Proporcional del Impuesto - Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

How to fill out Broward Florida Representaciones De Medición Y Ajuste De La Parte Proporcional De Los Inquilinos Participación Proporcional Del Impuesto?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Broward Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Broward Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share from the My Forms tab.

For new users, it's necessary to make some more steps to get the Broward Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share:

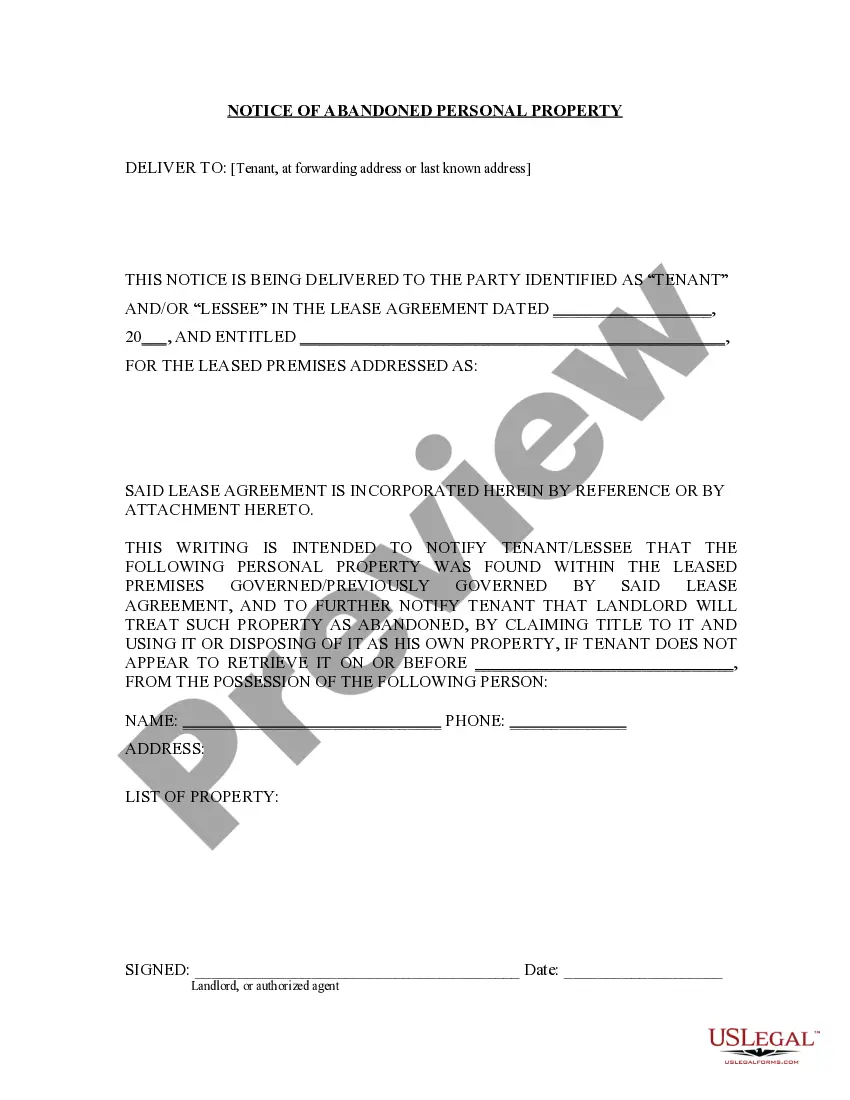

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!