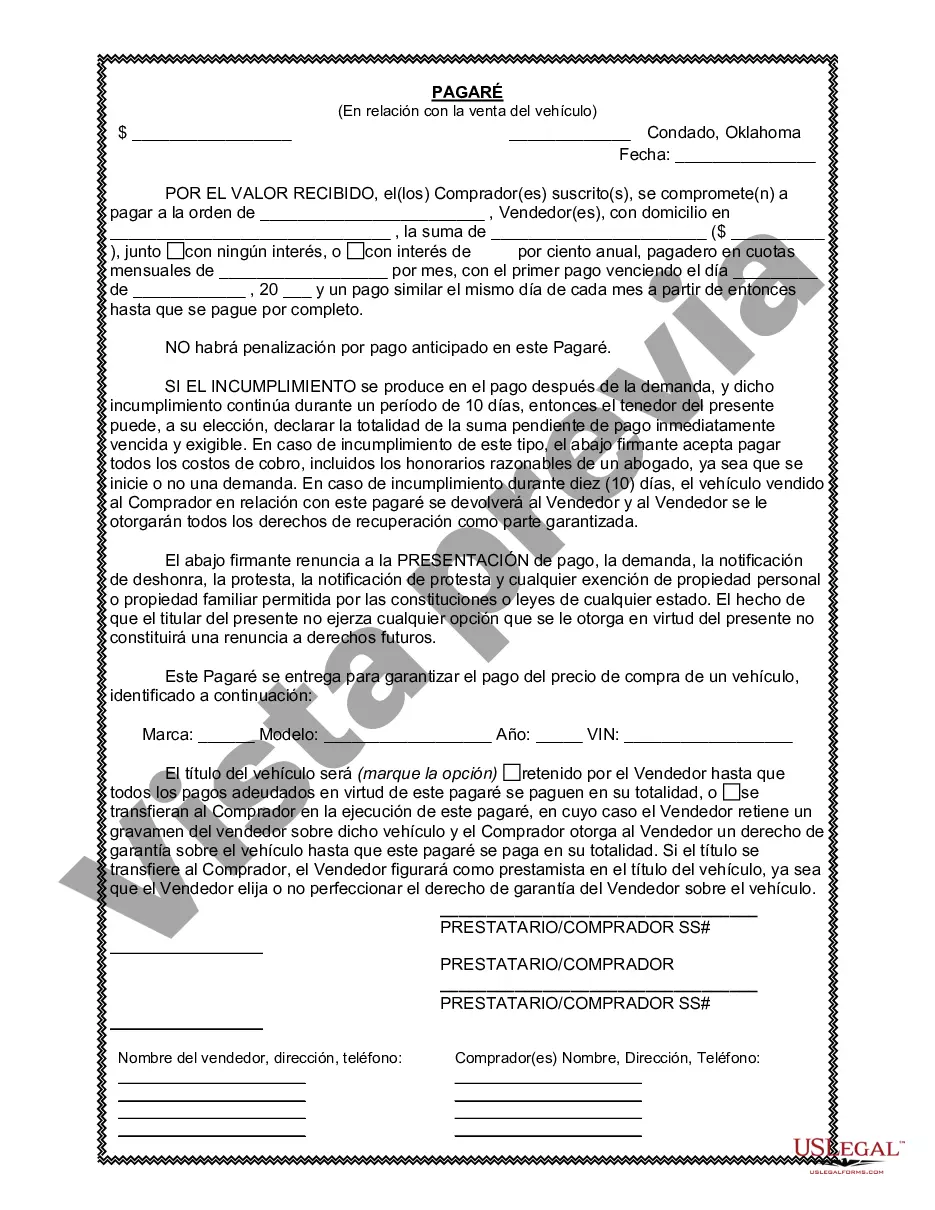

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller. It serves as evidence of a debt and details the repayment schedule, interest rate, and other important information. In Oklahoma City, Oklahoma, there are different types of promissory notes that may be used in connection with the sale of a vehicle or automobile. Some of these include: 1. Installment Sales Agreement: This type of promissory note outlines the terms of the installment payments made by the buyer to the seller. It specifies the amount, frequency, and duration of the payments. 2. Balloon Payment Promissory Note: This promissory note allows for a larger final payment, known as a balloon payment, to be made at the end of the loan term. It may have lower monthly payments but requires the buyer to make a significant payment to satisfy the remaining balance. 3. Secured Promissory Note: A secured promissory note includes a provision that allows the seller to repossess the vehicle if the buyer fails to make payments as agreed. It provides added security for the seller and may include terms related to the repossession process. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not include any collateral or security for the lender. It is solely based on the buyer's creditworthiness and repayment ability. 5. Due on Demand Promissory Note: This type of promissory note allows the seller to demand repayment in full at any time they choose. It provides flexibility for both parties but may require the buyer to secure alternative financing. When entering into a promissory note in connection with the sale of a vehicle or automobile in Oklahoma City, it is crucial to consult with a legal professional to ensure compliance with local laws and regulations. Both the buyer and seller must understand the terms and obligations outlined in the promissory note to avoid any disputes or legal issues in the future.A promissory note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller. It serves as evidence of a debt and details the repayment schedule, interest rate, and other important information. In Oklahoma City, Oklahoma, there are different types of promissory notes that may be used in connection with the sale of a vehicle or automobile. Some of these include: 1. Installment Sales Agreement: This type of promissory note outlines the terms of the installment payments made by the buyer to the seller. It specifies the amount, frequency, and duration of the payments. 2. Balloon Payment Promissory Note: This promissory note allows for a larger final payment, known as a balloon payment, to be made at the end of the loan term. It may have lower monthly payments but requires the buyer to make a significant payment to satisfy the remaining balance. 3. Secured Promissory Note: A secured promissory note includes a provision that allows the seller to repossess the vehicle if the buyer fails to make payments as agreed. It provides added security for the seller and may include terms related to the repossession process. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured promissory note does not include any collateral or security for the lender. It is solely based on the buyer's creditworthiness and repayment ability. 5. Due on Demand Promissory Note: This type of promissory note allows the seller to demand repayment in full at any time they choose. It provides flexibility for both parties but may require the buyer to secure alternative financing. When entering into a promissory note in connection with the sale of a vehicle or automobile in Oklahoma City, it is crucial to consult with a legal professional to ensure compliance with local laws and regulations. Both the buyer and seller must understand the terms and obligations outlined in the promissory note to avoid any disputes or legal issues in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.