The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

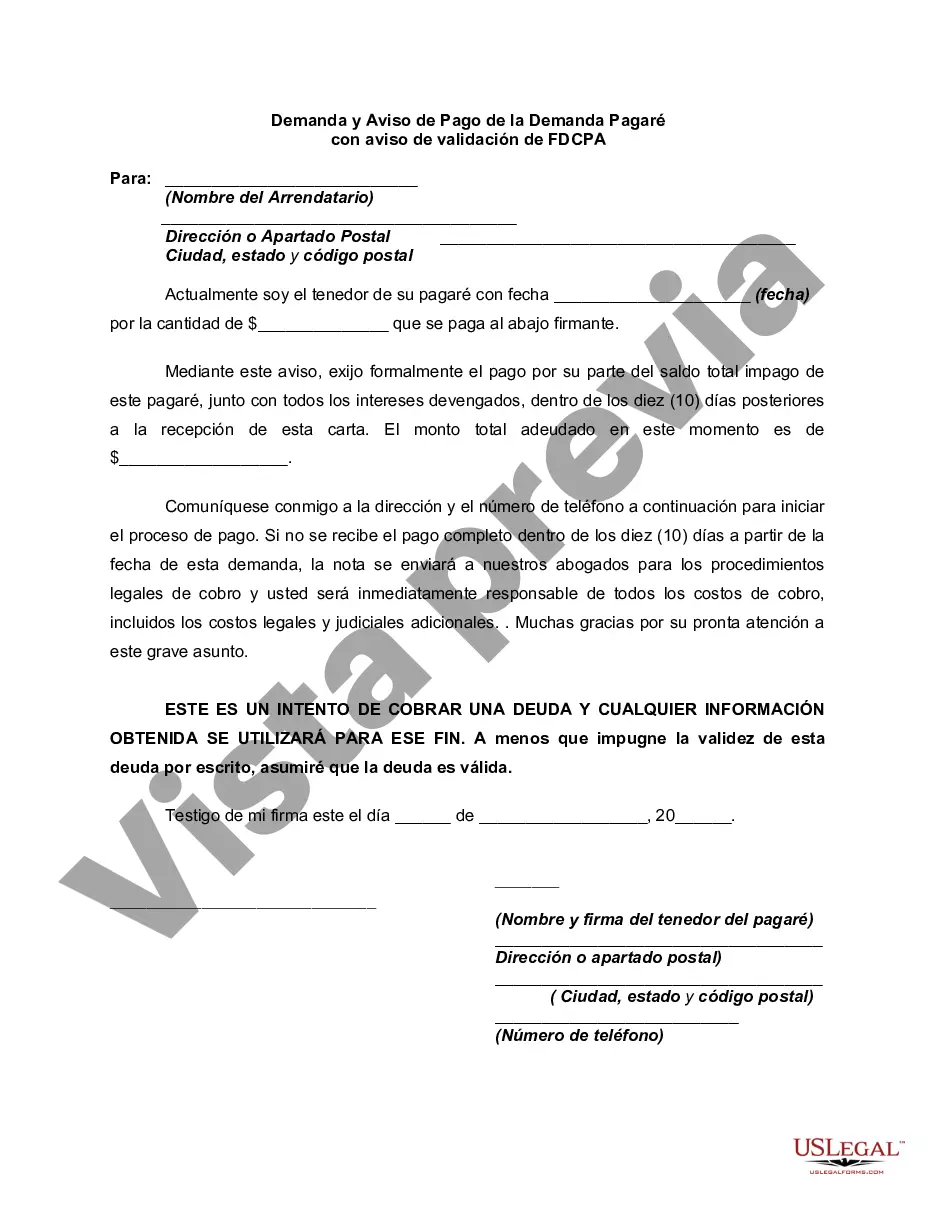

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

The Fair Debt Collection Practices Act (FD CPA) is a federal law in the United States established to protect consumers from unethical and abusive debt collection practices. It outlines a specific format that debt collectors must adhere to when communicating with debtors. This description will provide a detailed explanation of the FD CPA debt collection act format along with different types of FD CPA formats. The FD CPA requires debt collectors to follow specific guidelines when contacting consumers regarding their debts. The prescribed format ensures that debt collectors treat consumers fairly and prevent deceptive or harassing practices. Here is a breakdown of the essential components of the FD CPA debt collection act format: 1. Initial Communication: When making the first contact with a debtor, the debt collector must identify themselves and disclose that they are attempting to collect a debt. They should also inform the debtor that all communication will be used for debt collection purposes. 2. Validation Notice: Within five days of the initial communication, the debt collector must send a written notice to the debtor. This notice should include the amount owed, the name of the original creditor, and the debtor's right to dispute the debt within 30 days. 3. Cease and Desist: If the debtor sends a written request asking the debt collector to stop contacting them, the collector must honor this cease and desist request. They can only respond to acknowledge receipt of the request or notify the debtor of further legal actions, like filing a lawsuit. 4. Verification of Debt: If the debtor disputes the debt within the 30-day period, the collector must validate the debt by providing written verification. This includes documentation demonstrating the debt's validity, such as a copy of the original contract. 5. Prohibited Practices: The FD CPA prohibits debt collectors from engaging in certain practices. For instance, they cannot call outside reasonable hours, threaten, or use abusive language towards the debtor. 6. Recording Conversations: Some states allow debtors to record conversations with debt collectors without their consent. However, it is important to check state laws regarding this matter. Additionally, there are different types of FD CPA formats that might be utilized in various situations. Here are a few: 1. Written Correspondence: Debt collectors may send letters or emails to communicate with debtors. These written formats must follow the guidelines mentioned above. 2. Phone Calls: Debt collectors often use phone calls to contact debtors. During these conversations, they must adhere to the FD CPA act format, ensuring they comply with all regulations. 3. In-person Communication: In rare cases, debt collectors might meet with debtors face-to-face. Even in these instances, they must maintain the appropriate format and follow the guidelines stated in the FD CPA. By adhering to the FD CPA debt collection act format, debt collectors must treat consumers fairly and respectfully while collecting debts. Understanding this format is crucial for both debtors and collectors to ensure compliance with the law and maintain ethical debt collection practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.