Title: A Comprehensive Guide to Texas Insurance: Understanding the Types and Coverage Introduction: Texas, the second-largest state in the United States, offers a wide range of insurance options to protect its residents from various risks and uncertainties. This detailed description aims to provide a comprehensive overview of insurance in Texas, including different types and coverage options available. Texas Insurance Overview: Insurance is a mechanism that protects individuals, families, and businesses from the financial burden that may arise due to unforeseen events such as accidents, natural disasters, health issues, or property damage. In Texas, insurance plays a crucial role in safeguarding individuals' and entities' interests against potential risks. Types of Texas Insurance: 1. Auto Insurance: Auto insurance is mandatory in Texas, requiring drivers to have minimum liability coverage to protect themselves and others in case of accidents. Additional coverage options include comprehensive, collision, under insured/uninsured motorist, and personal injury protection. 2. Home Insurance: Homeowners insurance covers damages to a residential property and its contents caused by events like fires, severe weather, vandalism, theft, or liability claims. It typically includes coverage for the structure, personal belongings, liability protection, and additional living expenses during repairs. 3. Renters Insurance: Renters insurance provides coverage for personal belongings, liability, and additional living expenses for individuals residing in rented apartments or homes. It ensures protection against theft, fire, vandalism, or other covered events. 4. Flood Insurance: Given Texas's vulnerability to hurricanes and heavy rainfall, flood insurance is of utmost importance. Many areas in Texas are prone to flooding, making this coverage crucial for homeowners, renters, and businesses. 5. Health Insurance: Health insurance helps individuals manage medical expenses and ensures access to quality healthcare services. In Texas, individuals can get coverage through employers, private insurance providers, or government programs such as Medicaid and the Children's Health Insurance Program (CHIP). 6. Life Insurance: Life insurance provides financial protection for the policyholder's beneficiaries in case of their death. It helps cover funeral expenses, replace lost income, settle outstanding debts, or leave a financial legacy for loved ones. 7. Commercial Insurance: Businesses in Texas need specialized insurance coverage for their assets, employees, and liabilities. Commercial insurance offers protection against property damage, lawsuits, workers' compensation claims, and other risks specific to each industry or profession. Conclusion: Understanding the different types of insurance available in Texas is essential for ensuring individuals, families, and businesses are adequately protected against unexpected events. Whether it's auto, home, renters, flood, health, life, or commercial insurance, each type serves a unique purpose in mitigating risks and providing financial security in the Lone Star State. Being knowledgeable about the available options and consulting with insurance professionals can help Texans make informed decisions to safeguard their futures.

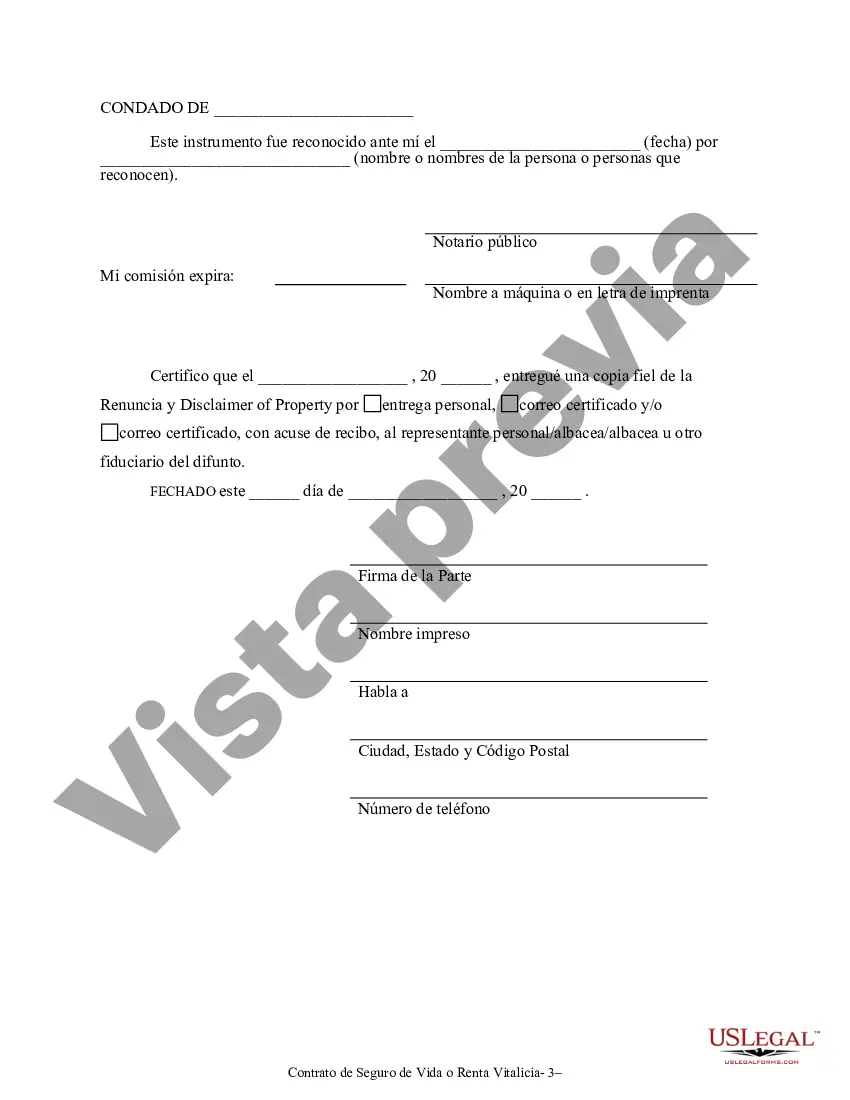

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Seguro Vida - Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description Renuncia Bienes

How to fill out Texas Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

Get access to quality Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract samples online with US Legal Forms. Steer clear of days of wasted time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find more than 85,000 state-specific authorized and tax samples that you can save and complete in clicks within the Forms library.

To receive the example, log in to your account and click on Download button. The document is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- See if the Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract you’re considering is appropriate for your state.

- See the form using the Preview function and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Select a preferred file format to save the file (.pdf or .docx).

Now you can open up the Texas Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract template and fill it out online or print it out and do it by hand. Consider giving the papers to your legal counsel to make certain all things are filled out properly. If you make a error, print and complete application again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and get more templates.