Title: Understanding NY Notice Salary Withdrawal: Types and Detailed Explanation Introduction: NY Notice Salary Withdrawal refers to a legal provision or labor law regulation that allows an employee to receive their full salary for a specific period after giving notice of their intent to leave a job position. This concept ensures that employees are financially supported during the notice period and can transition smoothly to their next employment. In this article, we will delve into the different types of NY Notice Salary Withdrawal and provide a detailed explanation of each. Types of NY Notice Salary Withdrawal: 1. NY Notice Salary Withdrawal with Full Pay: In this type, the employee is entitled to receive their regular salary for the entire duration of the notice period. This ensures that the individual can maintain their financial stability while seeking alternative employment. 2. NY Notice Salary Withdrawal with Pro-Rated Pay: Pro-rated pay is applicable when an employee has worked less than the full notice period specified in their contract. In such cases, the salary withdrawal is adjusted based on the number of days worked during the notice period. The rate calculation considers the employee's basic pay divided by the total number of working days in a month. 3. NY Notice Salary Withdrawal with Benefits: Apart from regular salary, this type of withdrawal includes additional benefits provided by the employer, such as healthcare coverage, retirement contributions, or other allowances. These benefits continue to be provided until the end of the notice period, ensuring the employee's well-being during the transition phase. Detailed Explanation: NY Notice Salary Withdrawal provides financial security to the employee while they actively search for alternative employment. When an employee submits their resignation letter or notice of termination, the employer must comply with the NY Notice Salary Withdrawal regulations. The notice period, which determines the length of employment after notice, varies based on factors such as labor laws, contract terms, and industry practices. It is vital to review the employment contract or labor laws applicable within the relevant jurisdiction to determine the appropriate notice period. During the notice period, the employee's salary is withdrawn periodically as per the agreed terms. The frequency of salary withdrawals usually adheres to the regular payroll schedule, be it monthly, bi-weekly, or weekly. In the case of NY Notice Salary Withdrawal with Full Pay, the employee receives their regular salary, including any applicable bonuses, allowances, or commissions, until their notice period ends. This type is the most beneficial to the employee as they maintain their financial stability. For NY Notice Salary Withdrawal with Pro-Rated Pay, the calculation takes into account the number of days worked during the notice period. Suppose an employee has worked for 10 days out of a 30-day notice period. In that case, the salary withdrawal will be calculated based on one-third (10/30) portion of their monthly salary. In NY Notice Salary Withdrawal with Benefits, the employer continues providing supplementary benefits until the end of the notice period. These benefits may include health insurance, retirement contributions, or any other company-specific perks outlined in the employment contract. Conclusion: NY Notice Salary Withdrawal ensures that employees are financially supported during their transition to new job opportunities while fulfilling the requirements of serving a notice period. By understanding the different types of NY Notice Salary Withdrawal, employees can ensure they receive proper compensation based on their contract terms and the labor laws applicable to their specific jurisdiction.

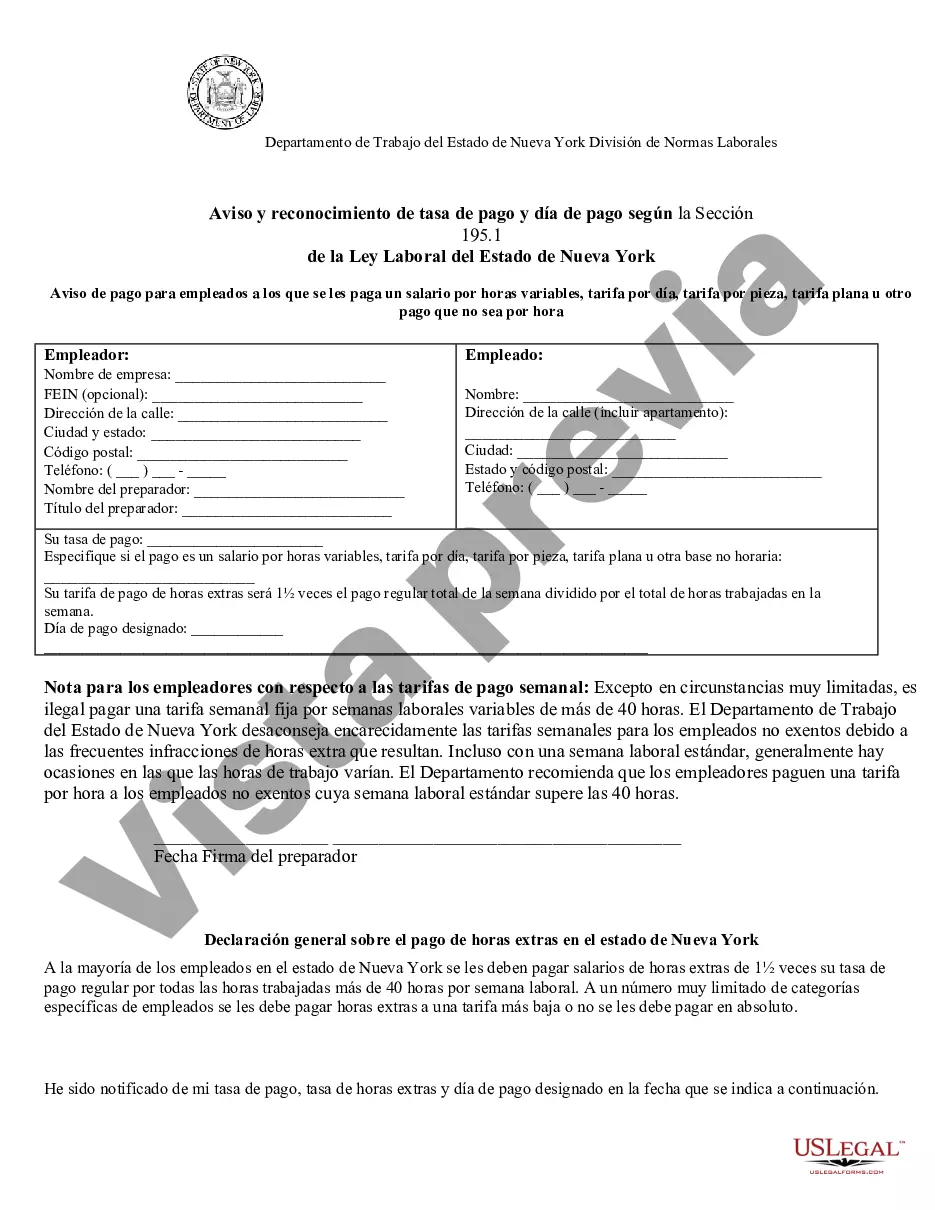

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Empleados Día Semana - New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday

Description Horas Empleados Semana

How to fill out Pago Salario Sea?

When it comes to completing New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday, you most likely visualize a long procedure that consists of getting a suitable form among countless very similar ones then needing to pay a lawyer to fill it out for you. In general, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form within just clicks.

If you have a subscription, just log in and click on Download button to have the New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday sample.

In the event you don’t have an account yet but want one, keep to the point-by-point guide below:

- Be sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and through visiting the Preview option (if readily available) to find out the form’s information.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure that after saving, you don't have to bother about enhancing content outside of your individual information or your business’s details. Be a part of US Legal Forms and get your New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday example now.