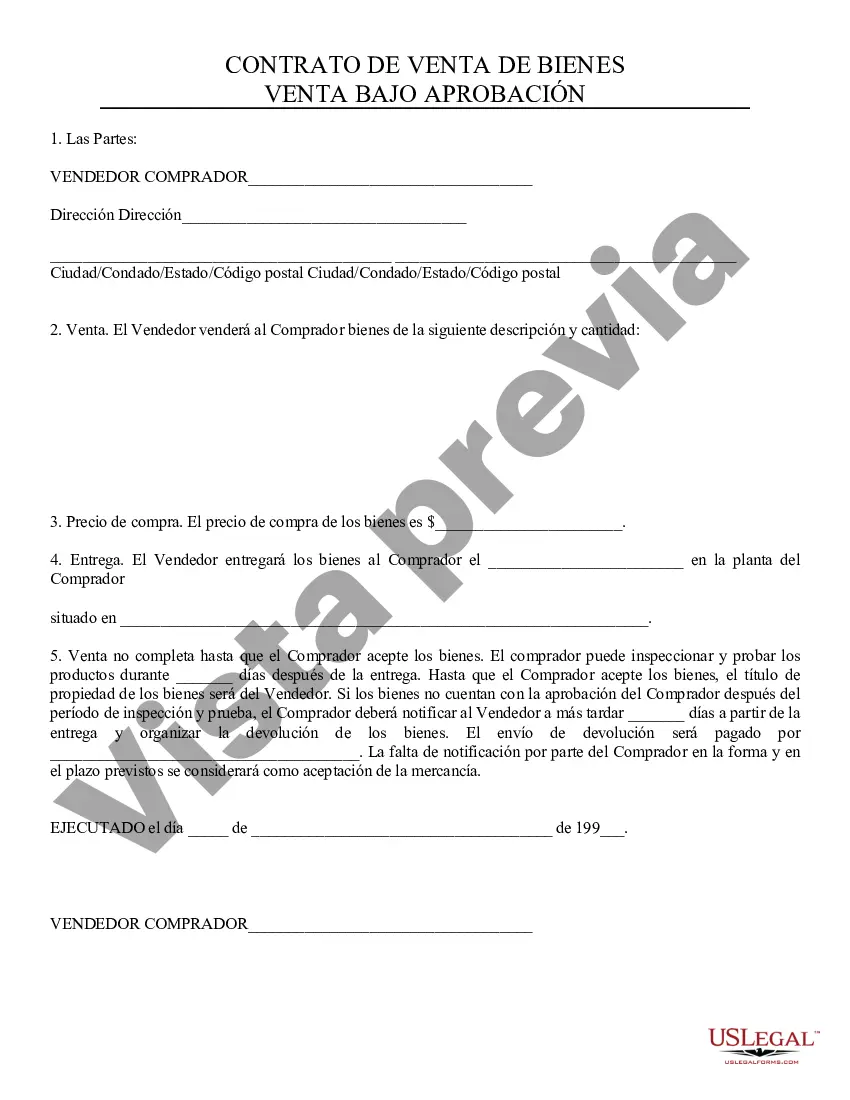

Sale of Goods - Approval: This is a Sales Contract between the Buyer and Seller for specific merchandise. It details the responsibilities to eachother, which includes the Buyer's right to inspect the goods for a number of days, to be decided upon by both parties. If the Buyer retains the goods past the allotted number of days, satisfaction will be presumed and payment should be arranged. This agreement should be signed by both parties in front of a Notary Public. This form is available for download in both Word and Rich Text formats.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Venta de Bienes, Aprobación - Arizona Sale of Goods, Approval

Description

How to fill out Arizona Venta De Bienes, Aprobación?

If you're searching for exact Arizona Sale of Goods, Approval templates, US Legal Forms is just the right thing you need; reach documents made and verified by state-accredited lawyers. Utilizing US Legal Forms not merely helps save from worries concerning legitimate documentation; in addition, you keep time and effort, and money! Downloading, printing out, and filling in a professional form is much more affordable than inquiring a solicitor to do it for you.

To begin, complete your enrollment procedure by providing your email and building a password. Adhere to the steps beneath to create an account and get the Arizona Sale of Goods, Approval template to remedy your circumstances:

- Use the Preview tool or look at the file information (if offered) to be certain that the template is the one you require.

- Check its validness in your state.

- Click Buy Now to make an order.

- Go with a preferred pricing program.

- Create an account and pay out with the visa or mastercard or PayPal.

- Pick a convenient formatting and store the file.

And while, that’s it. In just a few simple actions you get an editable Arizona Sale of Goods, Approval. When you make your account, all upcoming requests will be processed even easier. Once you have a US Legal Forms subscription, just log in account and click the Download option you see on the for’s web page. Then, when you need to use this sample again, you'll constantly be able to find it in the My Forms menu. Don't spend your time and energy checking numerous forms on various web sources. Get precise templates from just one secure service!