Gap assignment of mortgage foreclosure refers to a specific scenario that arises during the foreclosure process when there is an absence or delay in the assignment of the mortgage. This situation can occur when the mortgage loan is transferred from one lender to another, and the assignment of the mortgage document is not completed or recorded in a timely manner. Gap assignment issues can complicate the foreclosure process and may have legal implications. When a borrower defaults on their mortgage payments, the lender has the right to foreclose on the property to recover the outstanding loan amount. However, in cases where the mortgage has been assigned from the original lender to another entity, the foreclosure process may encounter a gap if the assignment is not properly executed and recorded. The gap assignment of mortgage foreclosure can be categorized into two different types, primarily based on the stage at which the assignment issue becomes apparent: 1. Pre-Foreclosure Gap Assignment: In this type of gap assignment, the issue arises before the foreclosure process is initiated. For instance, if the original lender assigns the mortgage to a new entity, but the assignment is not properly documented or recorded, the new entity may face difficulties in initiating foreclosure proceedings. This can lead to delays and may require legal actions to rectify the assignment gap. 2. In-Process Gap Assignment: This type of gap assignment occurs during the foreclosure process itself. It typically happens when the original lender assigns the mortgage to another entity after the foreclosure process is underway. If the assignment is not recorded promptly, it can create complications, such as a need to pause the foreclosure process until the assignment is resolved satisfactorily. In both types of gap assignment of mortgage foreclosure, the lack of properly executed and recorded assignments can cause delays, confusion, and potentially legal challenges. These gaps raise questions regarding the legal standing of the assignee and can impact the validity and enforceability of the foreclosure. To resolve these issues, the assignee or the new lender may need to take necessary steps to cure the assignment gap. This could involve properly documenting and recording the assignment, notifying the borrower and other parties involved, and ensuring that the foreclosure process proceeds smoothly while complying with the applicable laws and regulations. In summary, gap assignment of mortgage foreclosure refers to the challenges that arise when there are delays or omissions in properly assigning and recording the mortgage loan during the foreclosure process. It can result in legal complications and may hinder the smooth progression of the foreclosure. Proper attention to assignment documentation and prompt resolution of any gaps are essential to avoid potential issues and ensure a successful foreclosure process.

Gap Assignment Of Mortgage

Description Assignment Of Mortgage Definition

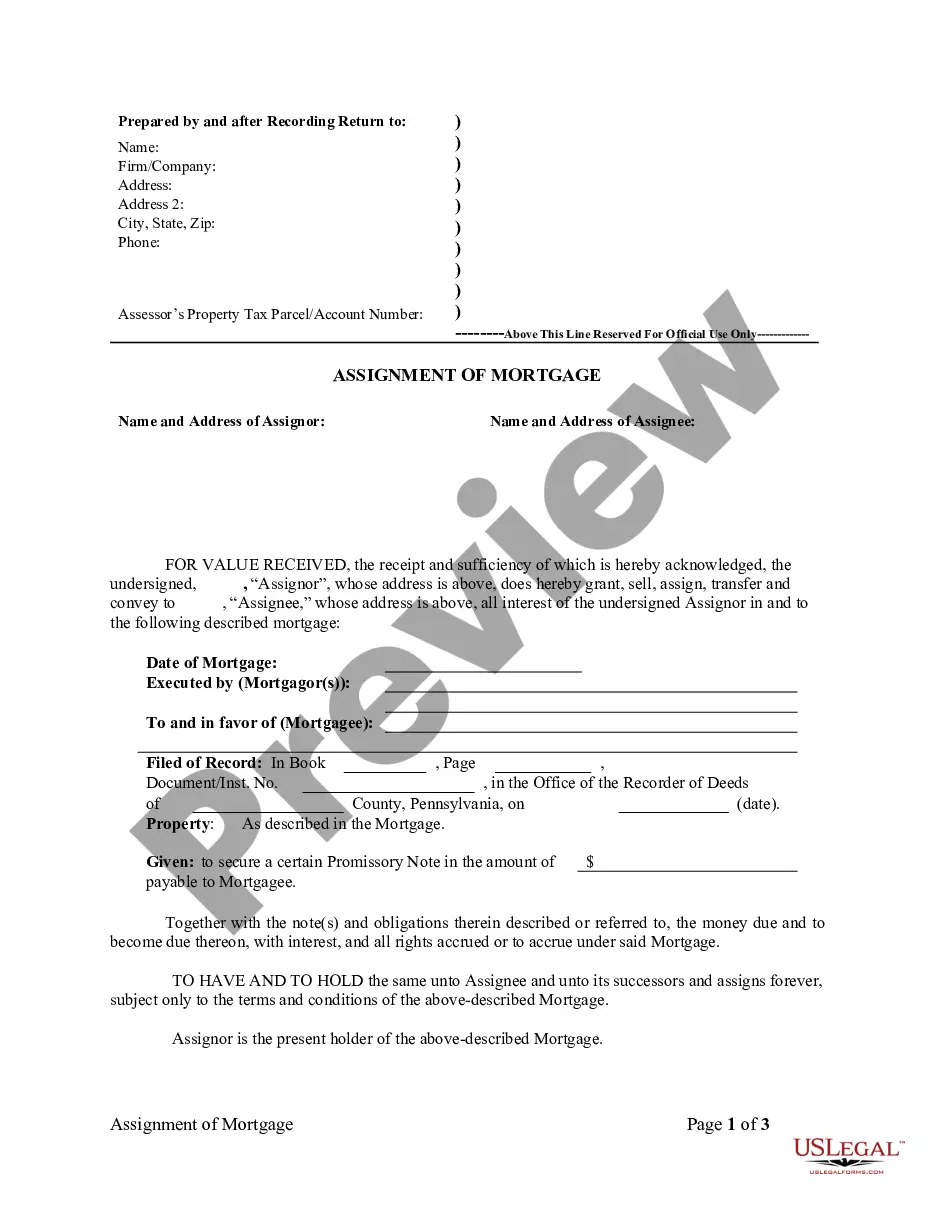

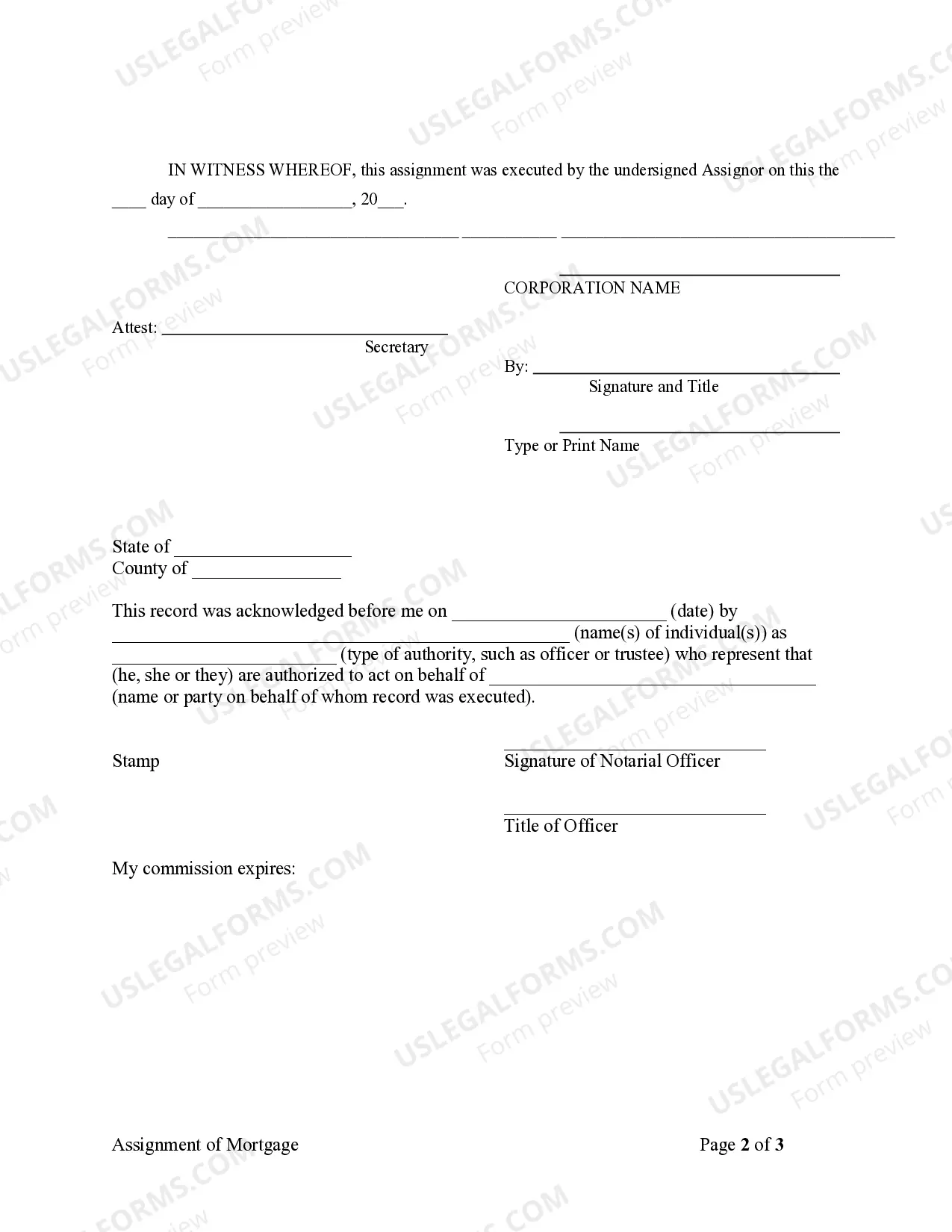

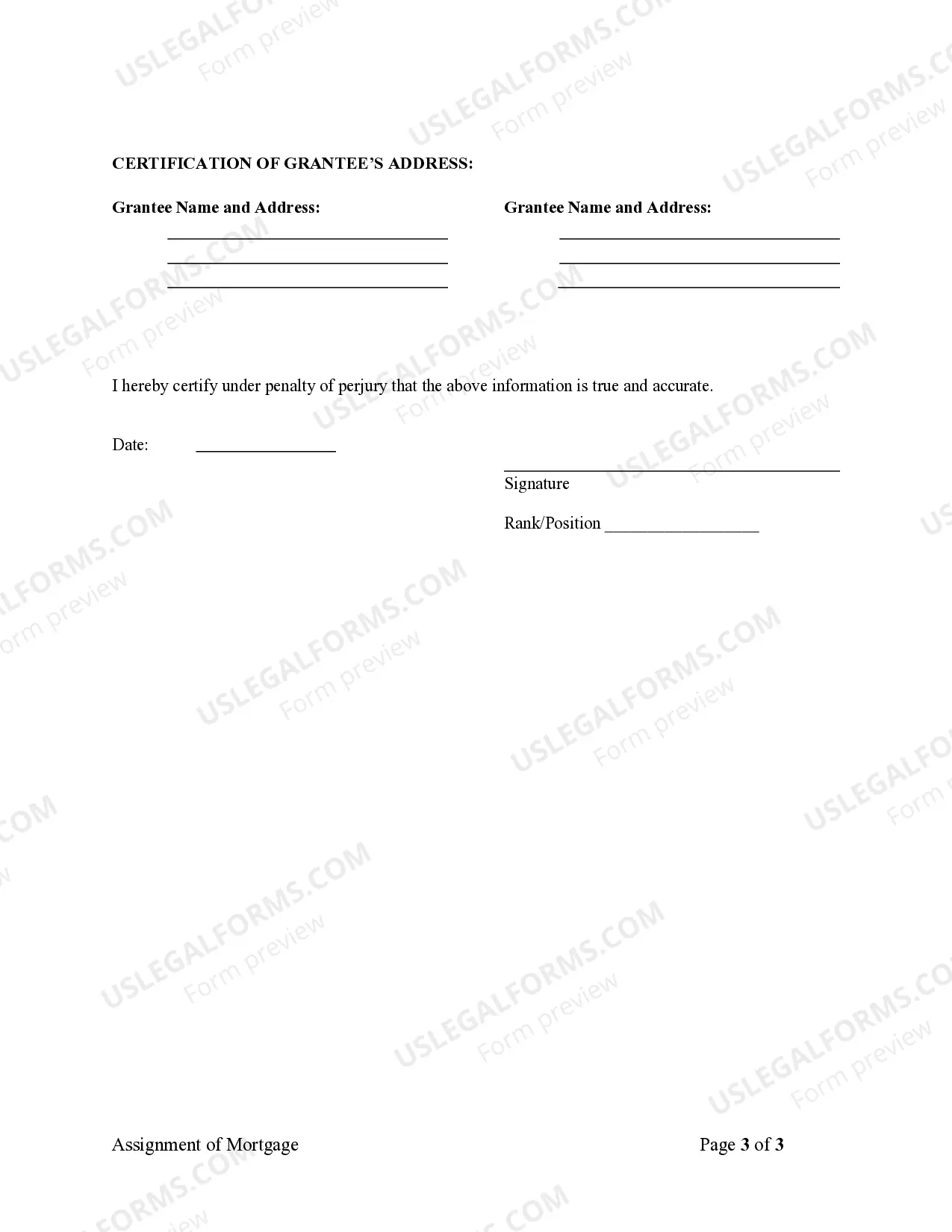

How to fill out Pennsylvania Assignment Of Mortgage By Corporate Mortgage Holder?

Creating papers isn't the most straightforward task, especially for people who almost never work with legal paperwork. That's why we advise making use of correct Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder templates made by professional attorneys. It allows you to avoid troubles when in court or dealing with formal institutions. Find the files you want on our site for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the file webpage. After downloading the sample, it’ll be stored in the My Forms menu.

Customers with no a subscription can quickly get an account. Make use of this short step-by-step help guide to get the Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder:

- Make sure that the sample you found is eligible for use in the state it is necessary in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Buy Now if this file is the thing you need or return to the Search field to find another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After completing these easy actions, you are able to fill out the form in an appropriate editor. Double-check filled in information and consider asking a legal professional to examine your Pennsylvania Assignment of Mortgage by Corporate Mortgage Holder for correctness. With US Legal Forms, everything becomes much simpler. Test it now!