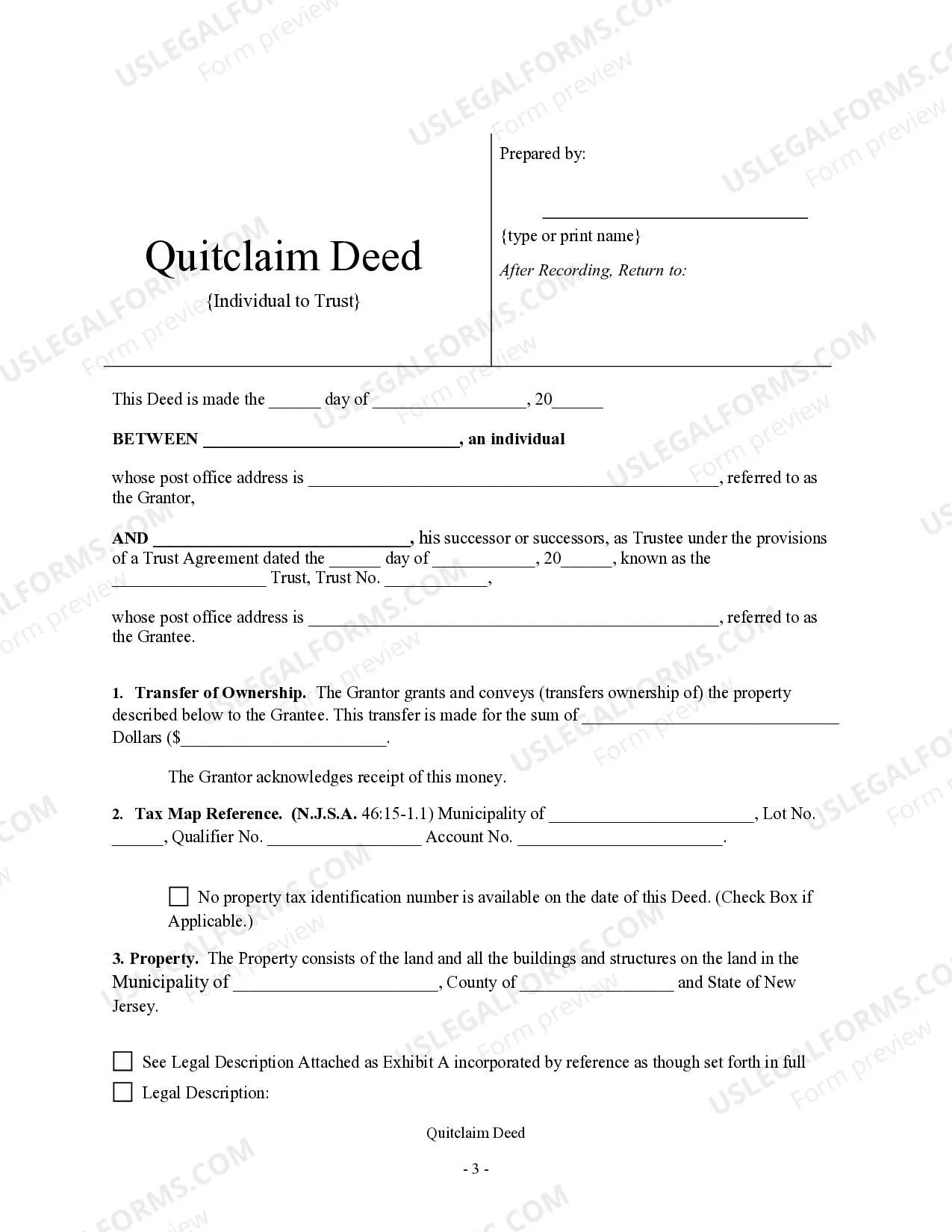

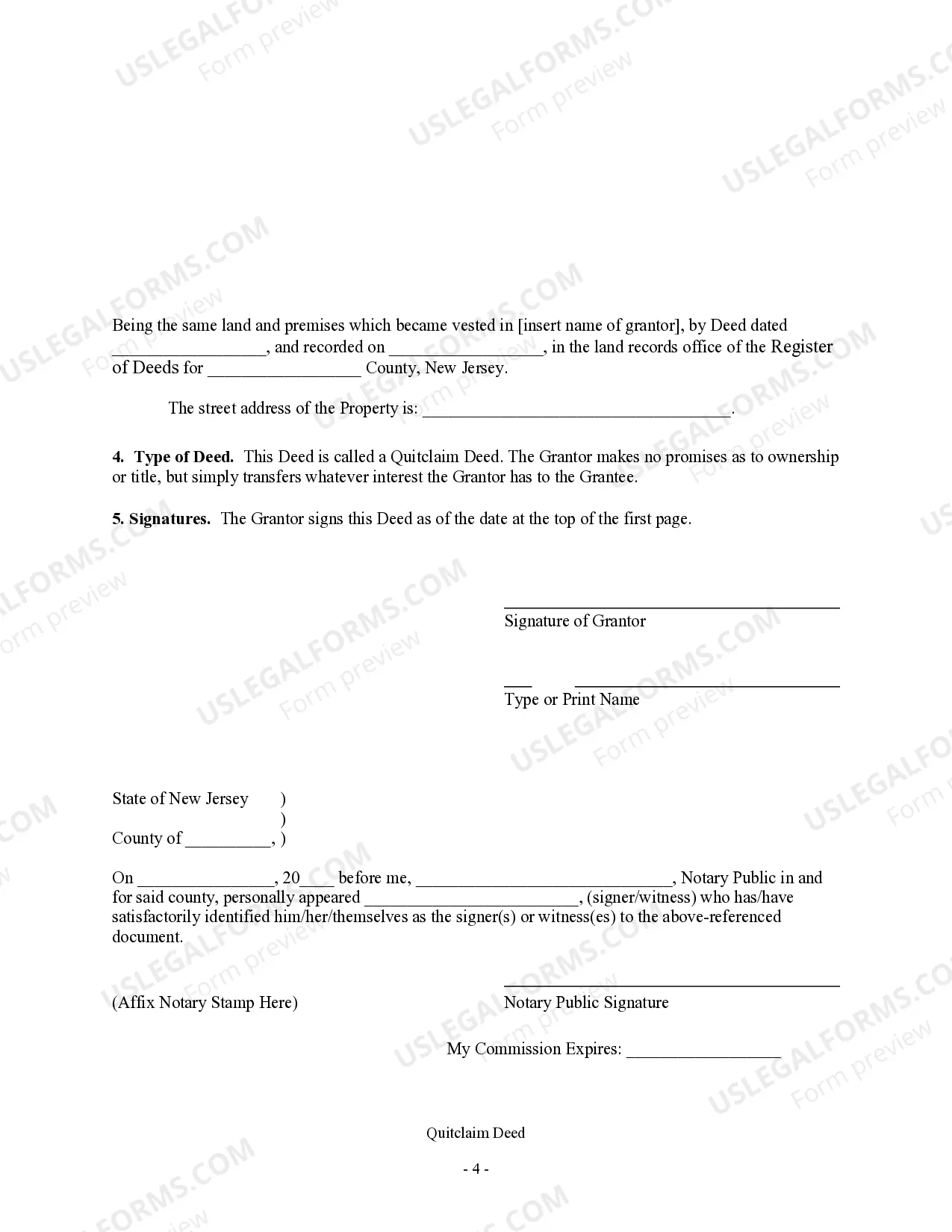

This form is a Quitclaim Deed where the grantor is an individual and the grantee is the trustee of a trust taking the property as trustee. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

When it comes to property transfers and estate planning, two terms that often come up are Quitclaim Deed and Irrevocable Trust. Understanding the differences between these two legal instruments is crucial for individuals looking to transfer their property or protect their assets. Let's delve into the details of each and explore various types associated with Quitclaim Deeds and Irrevocable Trusts. Quitclaim Deed: A Quitclaim Deed is a legal document used to transfer ownership interest in a property from one party (the granter) to another (the grantee). Unlike a warranty deed, which provides certain assurances and warranties about the title, a quitclaim deed offers no guarantees regarding the property's title. The granter essentially relinquishes any claims or rights they may have in the property. This type of deed is commonly used in situations where the transfer is happening between family members or acquaintances, or when there is an existing level of trust between the parties involved. Different Types of Quitclaim Deeds: 1. Individual-to-Individual Quitclaim Deed: This is the most common type of quitclaim deed, where one individual transfers their ownership interest to another individual. 2. Joint-to-Individual Quitclaim Deed: In this scenario, multiple owners who jointly hold the property transfer their interests to an individual. 3. Joint-to-Joint Quitclaim Deed: This is applicable when one or more joint owners transfer their interests to other joint owners. 4. Entity-to-Individual Quitclaim Deed: Sometimes, properties held under business entities, such as corporations or limited liability companies (LCS), are transferred to individuals via a quitclaim deed. Irrevocable Trust: An Irrevocable Trust is a legal arrangement that holds assets or property separately from the granter's estate. Once established, this type of trust cannot be modified, amended, or revoked without the consent of all named beneficiaries. Irrevocable trusts are often used for estate planning, asset protection, and tax advantages. By placing assets into an irrevocable trust, individuals can shield them from potential creditors or lawsuits while ensuring controlled distribution to beneficiaries. Different Types of Irrevocable Trusts: 1. Life Insurance Trust: This trust owns life insurance policies, removing their value from the granter's estate and providing tax benefits upon death. 2. Charitable Remainder Trust: It allows individuals to donate assets to a charitable organization while still receiving income from those assets during their lifetime. 3. Qualified Personnel Residence Trust: This trust facilitates the transfer of a primary residence or vacation home to heirs at a reduced value for estate tax purposes. 4. Granter Retained Annuity Trust: This trust permits the granter to receive an annuity payment for a specific period while transferring the remaining assets to beneficiaries tax-free. Understanding the variations between Quitclaim Deeds and Irrevocable Trusts is crucial, as they serve different purposes. Quitclaim Deeds primarily deal with property transfers, while Irrevocable Trusts focus on long-term asset management, estate planning, and protection. Seeking legal advice from professionals specializing in real estate and estate planning is highly recommended before proceeding with either method.