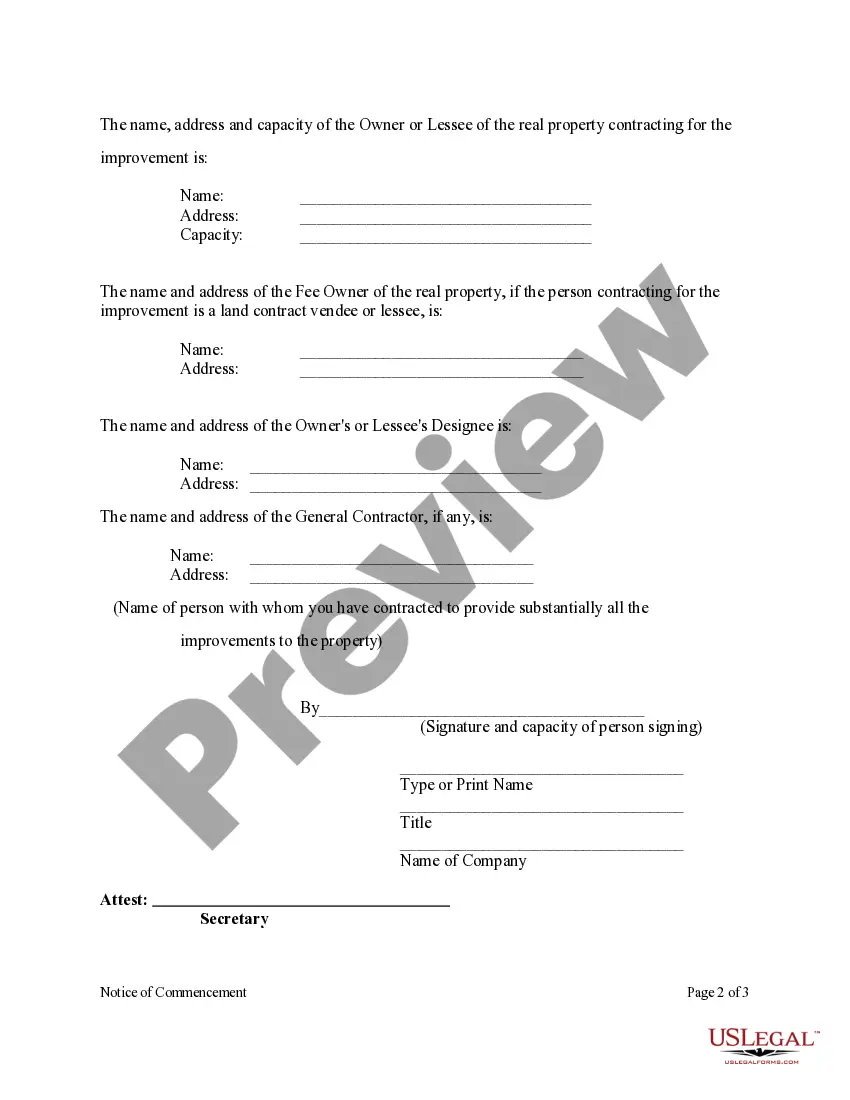

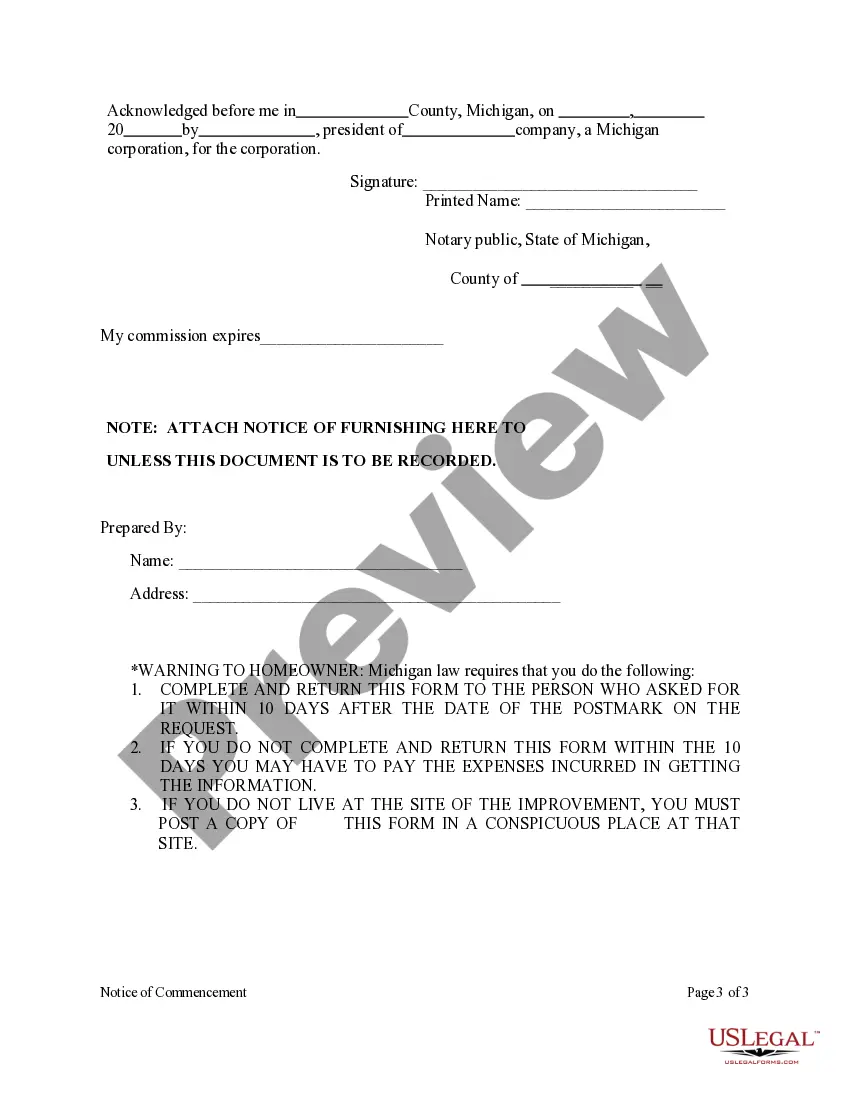

A Notice of Commencement is filed with the recorder of deeds by a property owner before improvements begin. It serves to put any party with an interest in the property on notice that improvements which may result in a lien are commencing. A copy of this form must be provided to any contractor, subcontractor or laborer who makes a written request.

Title: Michigan Corporation Form for Buying Foreign Shares: A Comprehensive Overview Introduction: In the increasingly globalized world of business, Michigan corporations provide a range of opportunities for investors to expand their portfolios by acquiring foreign shares. This article delves into the details of the Michigan corporation form for buying foreign shares, offering clarity on the subject and exploring potential types of corporations involved. 1. Understanding the Michigan Corporation Form: Michigan offers various legal structures for corporations, enabling investors to engage in international investments. The corporation form is particularly popular due to its limited liability protection, perpetual existence, and flexibility in capital acquisition. 2. Process of Buying Foreign Shares: Michigan-based corporations can purchase foreign shares by following a well-defined procedure. Firstly, they must comply with federal regulations such as the Foreign Corrupt Practices Act (CPA) and the Securities Exchange Commission (SEC) guidelines. Secondly, companies must carry out thorough due diligence to safeguard against potential risks, ensuring compliance with local laws and regulations in the target country. 3. Types of Michigan Corporation Forms for Buying Foreign Shares: a. C-Corporations: C-Corporations are a commonly chosen form for buying foreign shares due to their ability to attract shareholders and issue multiple classes of stock. Their structure offers limited liability and opportunities for substantial growth. C-Corporations are subject to double taxation, where both the corporate profits and shareholder dividends are taxed. b. S-Corporations: S-Corporations are considered pass-through entities, allowing shareholders to pass corporate income, deductions, and credits onto their personal tax returns. However, S-Corporations have specific eligibility criteria, such as having a maximum of 100 shareholders and one class of stock. Though they are advantageous for domestic investments, S-Corporations may have limitations when it comes to buying foreign shares. c. Limited Liability Companies (LCS): While not strictly classified as a corporation, LCS are increasingly popular in Michigan for foreign share purchases. An LLC provides limited liability protection for its members and flexibility in terms of ownership and management structure. Its pass-through taxation feature makes it an attractive option for investors seeking to purchase foreign shares. 4. Key Considerations: a. Compliance with Local Laws: To successfully purchase foreign shares, Michigan corporations need to understand and adhere to the specific legal requirements imposed by the country from which they are sourcing shares. Legal consultations and expert advisory services are essential to mitigate any potential risks. b. Tax Implications: Investors must consider the tax consequences of purchasing foreign shares and how it will impact their overall tax liability. Seeking guidance from tax professionals can ensure compliance and optimize tax outcomes. c. Exchange Rate Management: Volatility in exchange rates can influence investment returns when buying foreign shares. Corporations should actively monitor currency fluctuations and consider hedging strategies to minimize potential risks. Conclusion: Michigan corporations provide a robust and flexible framework for investors to acquire foreign shares. Through various forms such as C-Corporations, S-Corporations, and LCS, Michigan-based companies have the opportunity to diversify their investments while navigating the legal and tax complexities associated with international acquisitions. By understanding the intricacies of the Michigan corporation form for buying foreign shares, investors can bolster their portfolios and expand their global presence effectively.