A letter of guarantee for an auto loan is a document provided by a third party, usually a financial institution or a creditworthy individual, to assure the lender that they will be responsible for loan payments in the event that the borrower defaults. This letter acts as a form of collateral, offering a guarantee to the lender and increasing the chances of loan approval. The primary purpose of a letter of guarantee for an auto loan is to minimize the lending risk for the financial institution and provide assurance that the loan will be repaid. This letter demonstrates to the lender that there is a strong support system in place in case the borrower cannot fulfill their obligations. There are several types of letters of guarantee for auto loans, each with its own specific characteristics and requirements: 1. Personal guarantee letter: This is a letter provided by an individual who agrees to personally take responsibility for the auto loan in case of default. The person must have a good credit history and be able to demonstrate financial stability to be considered a reliable guarantor. 2. Corporate guarantee letter: In the case of a business auto loan, this type of guarantee is provided by a company or corporation, pledging to make the loan payments if the borrower fails to do so. The business should have a proven track record and sufficient assets to back up the guarantee. 3. Bank guarantee letter: This type of letter is issued by a financial institution to guarantee the payment of the auto loan. The bank acts as the guarantor, ensuring that the loan will be repaid. This type of guarantee is often sought by borrowers who may not have strong personal credit history or established businesses. 4. Conditional guarantee letter: A conditional guarantee letter specifies certain conditions that must be met for the guarantee to be in effect. This could include factors such as on-time payment history or maintaining a certain credit score. It is essential to note that the specific requirements, terms, and conditions for a letter of guarantee for an auto loan may vary depending on the lender and the borrower's financial situation. It is advisable to consult with the lender directly to understand their specific requirements and to ensure the letter meets their criteria. In conclusion, a letter of guarantee for an auto loan acts as a safeguard for the lender, assuring them that payment will be made in the event of default. Various types of letters of guarantee exist, including personal, corporate, bank, and conditional guarantees, each catering to specific borrower circumstances.

Letter Of Guarantee

Description Release Letter From Company

How to fill out Letter Of Guarantee Sample?

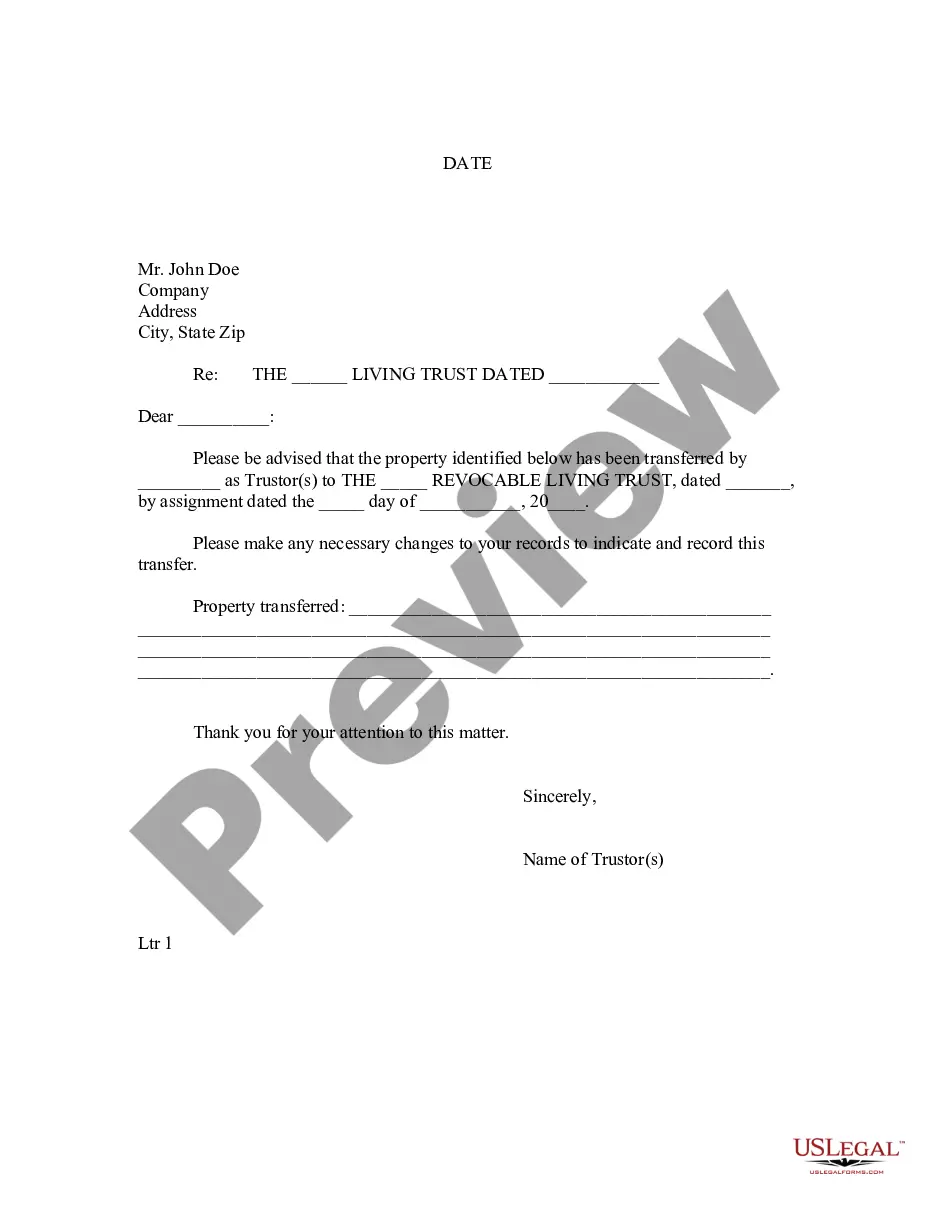

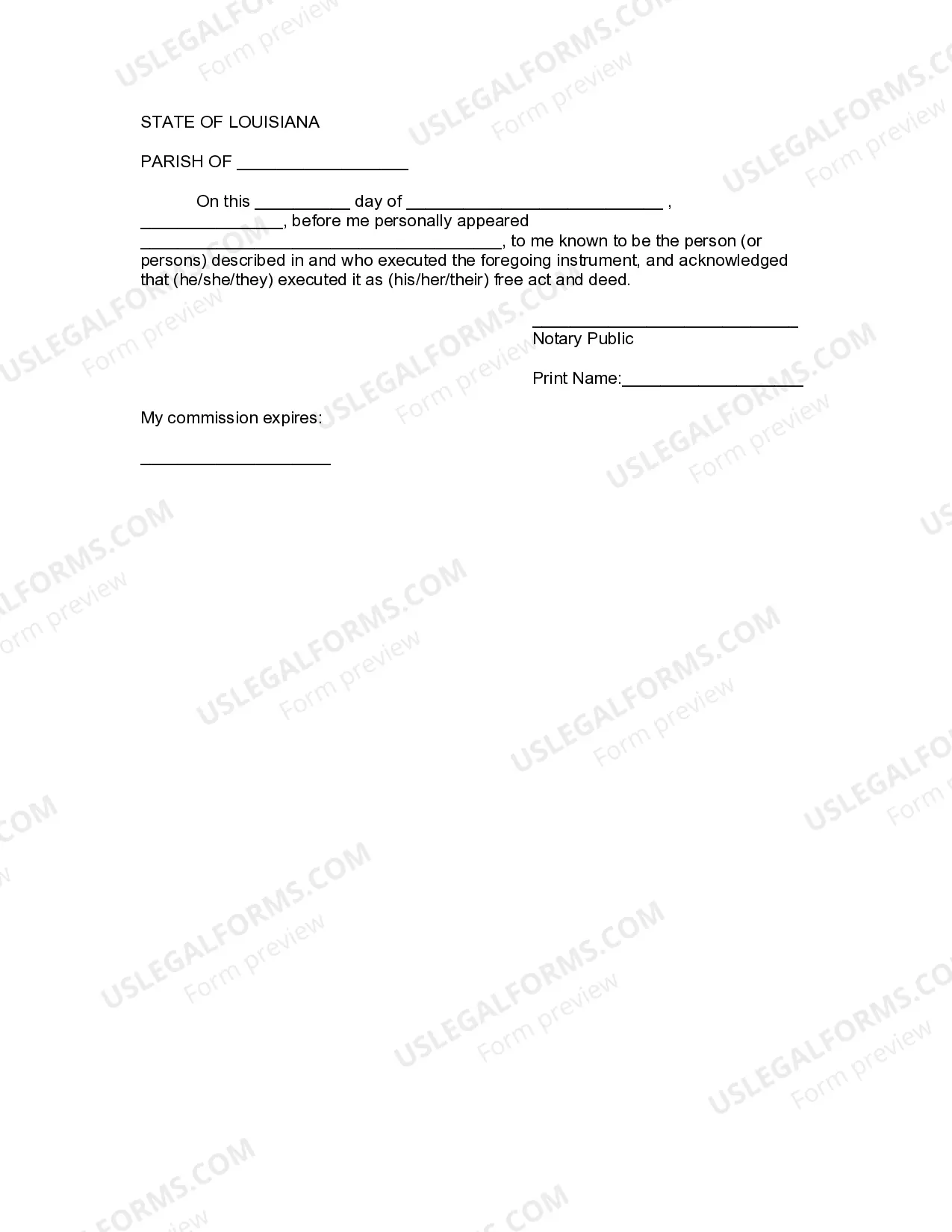

Welcome to the largest legal documents library, US Legal Forms. Here you can get any example such as Louisiana Letter to Lienholder to Notify of Trust templates and download them (as many of them as you want/need to have). Make official files with a several hours, instead of days or weeks, without spending an arm and a leg on an legal professional. Get the state-specific example in a few clicks and feel assured understanding that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and then click Download near the Louisiana Letter to Lienholder to Notify of Trust you want. Due to the fact US Legal Forms is web-based, you’ll always have access to your saved forms, regardless of the device you’re using. See them inside the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our instructions below to start:

- If this is a state-specific form, check out its validity in the state where you live.

- See the description (if available) to understand if it’s the proper example.

- See much more content with the Preview function.

- If the example matches all of your needs, click Buy Now.

- To create your account, select a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you want (Word or PDF).

- Print the document and fill it out with your/your business’s info.

When you’ve filled out the Louisiana Letter to Lienholder to Notify of Trust, send out it to your attorney for verification. It’s an extra step but a necessary one for being sure you’re fully covered. Sign up for US Legal Forms now and access thousands of reusable samples.