Loading

Get Sc Dor Wh-1605 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR WH-1605 online

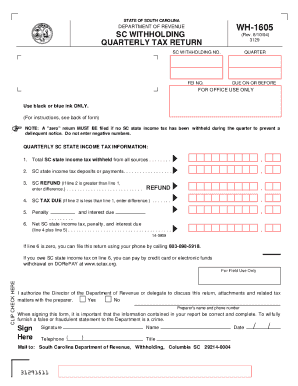

This guide provides a comprehensive overview of how to fill out the SC DoR WH-1605 form online. By following these clear instructions, users can successfully complete the document with confidence.

Follow the steps to fill out the SC DoR WH-1605 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the required personal information in the designated fields. This may include your full name, address, and contact details. Ensure that all information is accurate to avoid any delays.

- In the subsequent section, provide any relevant identification numbers or codes as specified in the form. This information helps to uniquely identify your submission.

- Next, you will need to complete the specific details related to the purpose of filling out the SC DoR WH-1605. Provide clear and concise explanations as required.

- Review all your entries carefully. Make sure that there are no typographical errors, and all fields have been filled out as instructed.

- Once you are satisfied with the information provided, you can proceed to save your changes. Choose to download the form for your records, print it for submission, or share it as needed.

Complete your documents online with ease and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When filling out your W-4 form, you typically claim yourself as one of your exemptions unless you meet certain criteria that allow otherwise. This helps to accurately reflect your tax situation and can help prevent under-withholding. Consider using the SC DoR WH-1605 for clarity on your exemption claims.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.