Loading

Get Or Dor Or-243 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DoR OR-243 online

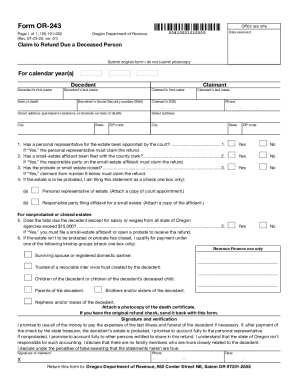

Filling out the OR DoR OR-243 form is a crucial step in claiming a refund due to a deceased person. This guide will help you navigate the online completion of the form, ensuring you provide all necessary information accurately.

Follow the steps to complete the OR DoR OR-243 form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the decedent's first and last name as well as their date of death in the provided fields. Make sure that all names and dates are accurate to avoid delays in processing.

- Enter the decedent's Social Security number (SSN) and your own Social Security number. This information is critical for verification purposes.

- Provide the permanent address of the decedent at the time of death. This includes the street address, city, state, and ZIP code.

- Indicate whether a personal representative for the estate has been appointed by the court by answering 'Yes' or 'No' in the appropriate field.

- Specify if a small-estate affidavit has been filed with the county clerk by selecting 'Yes' or 'No'. This helps determine who is authorized to claim the refund.

- Confirm whether the probate or small estate has closed by responding 'Yes' or 'No'. This information dictates the eligibility to claim the refund.

- If applicable, indicate your status by checking the appropriate box (personal representative or responsible party filing affidavit) and attach necessary documentation.

- Assess if the total due from all Oregon agencies exceeds $10,000 and indicate your response in the provided field. This affects the requirement for a small-estate affidavit.

- Select your relationship to the decedent from the kinship groups listed, ensuring to check only one box.

- Attach a photocopy of the death certificate, as well as the original refund check if you have it.

- Sign and date the form, verifying that the information provided is true and that you will account for the funds appropriately.

- After completing the form, save your changes, download a copy for your records, and be prepared to print it out.

- Finally, return the form to the Oregon Department of Revenue at the provided address.

Start filling out the OR DoR OR-243 form online today to ensure timely processing of your claim.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Benefits of starting an Oregon LLC: Protect your personal assets from your business liability and debts. Simple to create, manage, regulate, administer and stay in compliance. Easily file your taxes and discover potential advantages for tax treatment. Low cost to file ($100)

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.