Loading

Get Mt Form 2 - Schedule V 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Form 2 - Schedule V online

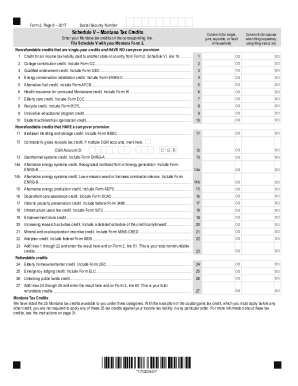

Filling out the MT Form 2 - Schedule V online is an essential step for reporting your Montana tax credits. This guide will walk you through each section of the form, providing detailed instructions to ensure a smooth process.

Follow the steps to fill out the MT Form 2 - Schedule V accurately.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

- Locate the section titled 'Column A' which is for individuals filing as single, joint, separate, or head of household. Here, you will enter your Montana tax credits on the corresponding lines.

- If you are filing separately and your partner has credits, refer to 'Column B' to enter their relevant tax credits using filing status 3a.

- For each tax credit listed in the form, enter the appropriate amount in the provided space. Before entering information, ensure you have the necessary forms mentioned, such as Form CC for the college contribution credit.

- For nonrefundable credits that have a carryover provision, make sure to consult the relevant forms to provide accurate information.

- Once all entries are made, add the totals for lines 1 through 22 to get your total nonrefundable credits and enter this on Form 2, line 51.

- For refundable credits, add lines 24 through 26 and enter the total on Form 2, line 60.

- After completing the form, use the options to save your changes, download, print, or share the completed document.

Begin processing your tax credits online today for a seamless experience.

Related links form

Department of Revenue Mitchell Building 125 N. Roberts P.O. Box 5805 Helena, MT 59604-5805444-6900TTY711CALL CENTER444-6900For questions relating to the tax types below, please contact our main Call Center number above, or send a fax to the corresponding number.Individual Income TaxFAX 444-4091 or 444-075072 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.