Loading

Get Vt Schedule In-117 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Schedule IN-117 online

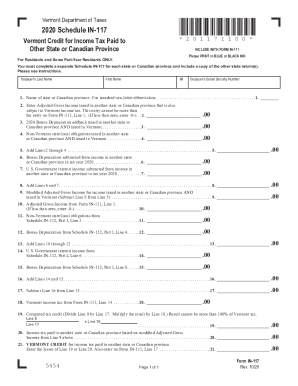

The VT Schedule IN-117 is a crucial form for Vermont residents and some part-year residents who are claiming a credit for income tax paid to other states or Canadian provinces. This guide provides clear, step-by-step instructions for filling out the form online, ensuring that users are well-equipped to complete it accurately.

Follow the steps to successfully fill out the VT Schedule IN-117 online.

- Press the ‘Get Form’ button to access the VT Schedule IN-117 and open it in your preferred online editor.

- Fill in the taxpayer’s last name, first name, and middle initial in the designated fields using blue or black ink.

- Enter the taxpayer’s Social Security Number in the appropriate space.

- In line 1, specify the name of the state or Canadian province using its standard two-letter abbreviation.

- For line 2, input the adjusted gross income that was taxed in another state or Canadian province. Ensure this amount does not exceed the figure on Form IN-111, Line 1; if it’s less than zero, input -0-.

- Line 3 requires you to enter any 2020 bonus depreciation that was taxed in both another state or Canadian province, as well as Vermont.

- On line 4, document any non-Vermont state or local obligations that were also taxed in another state or Canadian province and Vermont.

- Add the amounts from lines 2 through 4 and enter the total on line 5.

- In line 6, indicate any bonus depreciation that was subtracted from income in another state or Canadian province during the 2020 tax year.

- Line 7 requires the entry of U.S. government interest income that was subtracted from income in another state or Canadian province for the 2020 tax year.

- Calculate the total of lines 6 and 7 and write the result on line 8.

- For line 9, subtract line 8 from line 5 to determine the modified adjusted gross income for the income taxed in another state or Canadian province and taxed in Vermont.

- Input the adjusted gross income from Form IN-111, Line 1, in line 10; if it's less than zero, enter -0-.

- Line 11 should include any non-Vermont state or local obligations from Schedule IN-112, Part I, Line 3.

- On line 12, enter any bonus depreciation from Schedule IN-112, Part I, Line 4.

- Add the values from lines 10 through 12 and place the sum on line 13.

- For line 14, input the U.S. government interest income from Schedule IN-112, Part I, Line 6.

- Line 15 should reflect any bonus depreciation from Schedule IN-112, Part I, Line 8.

- Add the amounts on lines 14 and 15 and enter the result on line 16.

- Subtract line 16 from line 13 to calculate the result on line 17.

- In line 18, indicate the Vermont income tax from Form IN-111, Line 14.

- For line 19, compute the tax credit by dividing line 9 by line 17, then multiplying the result by line 18. Note that this result cannot exceed 100% of the Vermont tax.

- On line 20, enter the income tax paid to another state or Canadian province based on modified adjusted gross income from line 9.

- Finally, enter the lesser amount of line 19 or line 20 in line 21, which is the Vermont credit for income tax paid to another state or Canadian province. Also, enter this value on Form IN-111, Line 17.

- Once all fields are completed, you have the option to save your changes, download, print, or share the form as needed.

Complete your documents online today to ensure timely submission and accuracy.

Related links form

Once I successfully complete this service, when will I receive my refund? (added March 14, 2022) After you verify your identity and tax return information using this service, it may take up to nine weeks to complete the processing of the return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.