Get Nyc Dof Att-s-corp 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF ATT-S-CORP online

This guide offers step-by-step instructions on filling out the NYC DoF ATT-S-CORP form, which is essential for Subchapter S Corporations filing in New York City. By following these instructions, users can efficiently manage their documents online.

Follow the steps to complete the form accurately.

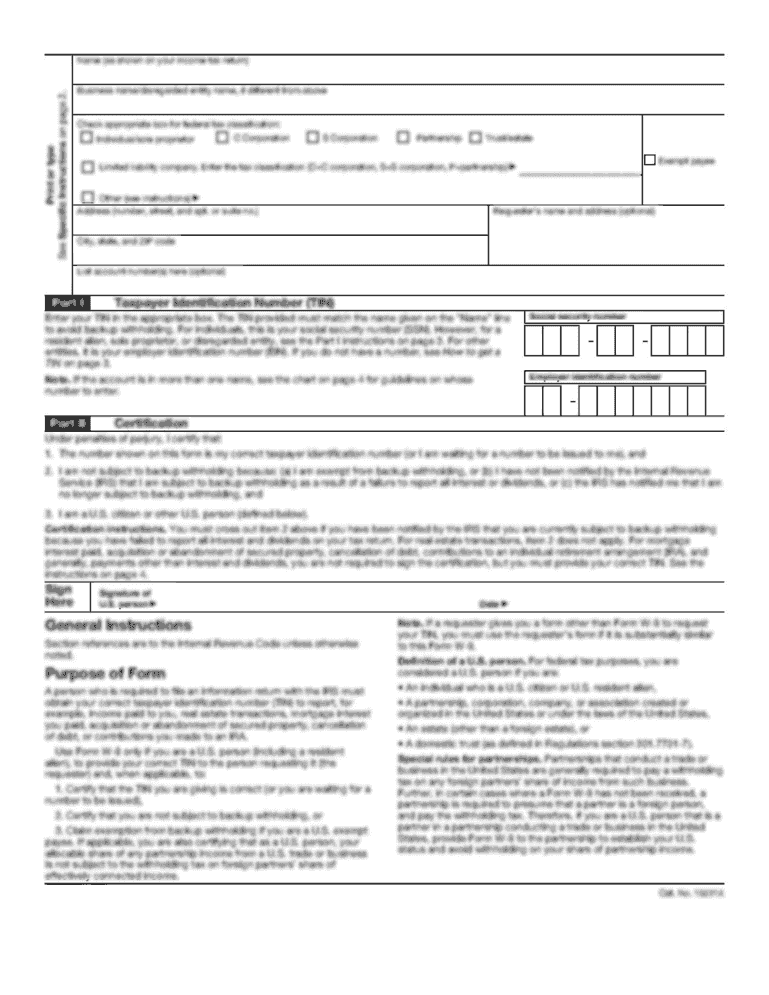

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Indicate the tax year by filling in either the calendar year or fiscal year dates in the provided fields.

- Enter the name of the entity as shown on related NYC forms such as NYC-1, NYC-3A, NYC-3L, NYC-4S, or NYC-4SEZ.

- Provide the Employer Identification Number (EIN) in the designated field.

- In Part I, list your additions to ordinary business income by filling in the appropriate amounts corresponding to lines 1 through 13 based on your Federal Form 1120S.

- Proceed to Part II to calculate deductions by filling in amounts on lines 15 through 20, ensuring you adjust any items applicable for C Corporation treatment as necessary.

- Complete Part III by calculating the Federal Taxable Income by subtracting total deductions (line 21) from total additions (line 14). Enter this value on line 22.

- Once all fields are accurately filled, save your changes, and you can either download, print, or share the completed form as needed.

Complete your NYC DoF ATT-S-CORP form online today for a streamlined filing experience.

Get form

Opening an S corp in New York City involves several steps. First, you must choose a unique name for your corporation and file a Certificate of Incorporation with the New York Department of State. After obtaining federal tax identification, you need to file Form 2553 with the IRS to elect S corporation status under the NYC DoF ATT-S-CORP rules. Consider using platforms like uslegalforms to streamline the filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.