Get Mn Dor Schedule M1cd 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1CD online

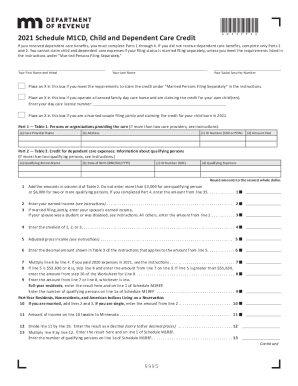

Filling out the MN DoR Schedule M1CD online can be a straightforward process when you understand each section and requirement of the form. This guide provides clear instructions to help you complete your Schedule M1CD accurately and efficiently, ensuring you can claim the credits for child and dependent care expenses. It is essential to follow each step carefully to maximize your potential benefits.

Follow the steps to complete the MN DoR Schedule M1CD online successfully.

- Press the ‘Get Form’ button to access the Schedule M1CD form and open it in your preferred online editor.

- Begin by entering your first name, middle initial, and last name in the designated fields. Ensure that the names match the Social Security records.

- Input your Social Security Number (SSN) in the provided section, as this is required for processing your claim.

- Check the appropriate boxes if you meet the criteria for claiming the credit under ‘Married Persons Filing Separately’ or if you operate a licensed family day care home for your child.

- In Part 1, complete Table 1 by providing information for the persons or organizations that provided care: include name, address, ID number, and the total amount paid for care.

- Proceed to Part 2, where you will complete Table 2. Enter information about qualifying persons, including their names, dates of birth, ID numbers, and qualifying expenses. Ensure the expenses are rounded to the nearest whole dollar.

- Add the amounts for qualifying expenses in Table 2 and ensure they do not exceed the limits set (e.g., $3,000 for one qualifying person, $6,000 for two or more). Enter any applicable earned income on the relevant lines.

- If applicable, complete Part 3 to report any dependent care benefits received, including carrying amounts forward or forfeited.

- Complete Part 4 to claim the dependent care credit, following detailed instructions on entering amounts from previous calculations.

- Once all sections are filled in correctly, save your changes, and choose to download, print, or share the completed form based on your needs.

Complete your MN DoR Schedule M1CD online today to ensure you receive all eligible tax benefits!

Related links form

In 2023, the income threshold set for the child and dependent care credit scheme is set at 43,000 dollars or less. This means those earning more will not be eligible to benefit from this scheme. Those who do meet the required criteria will be eligible for a rebate worth up to 3,000 dollars.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.