Loading

Get Mn Dor Schedule M1lti 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1LTI online

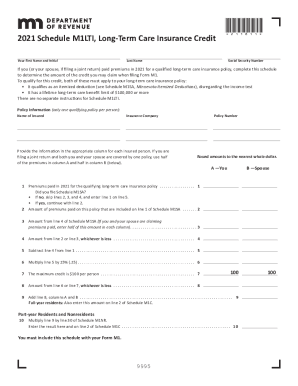

Filling out the Minnesota Department of Revenue Schedule M1LTI is a crucial step for those who paid premiums for a long-term care insurance policy in 2021. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to complete your Schedule M1LTI online.

- Click ‘Get Form’ button to access the Schedule M1LTI and open it for editing.

- Enter your first name and initial, last name, and Social Security number in the specified fields. Ensure the names match the ones on your tax documents.

- Provide information for the qualifying long-term care insurance policy. Input the name of the insured, the insurance company, and the policy number.

- Enter the total premiums paid in 2021 for the qualifying policy into the relevant fields for you and your spouse, if applicable.

- If you filed Schedule M1SA, fill out lines 2, 3, and 4 according to the instructions provided. If not, skip to line 5.

- Complete line 5 by subtracting the amount from line 4 from line 1. This reflects the adjusted premium amount.

- Calculate line 6 by multiplying the amount from line 5 by 25%. This indicates the potential credit you may claim.

- Insert the maximum credit amount of $100 per person on line 7 to ensure compliance with credit limits.

- For line 8, select the lesser amount between line 6 and line 7.

- Add the amounts from line 8 in both columns A and B and enter this total on line 9.

- If you are a full-year resident, input this amount on line 2 of Schedule M1C.

- Part-year residents should multiply the total from line 9 by line 30 of Schedule M1NR and document this result as instructed.

- Review all entries for accuracy before submitting. Ensure the Schedule M1LTI accompanies your Form M1.

Complete your Schedule M1LTI online now to ensure you receive the credits you deserve.

Related links form

How much tax do I withhold? You may either: Use the supplemental withholding rate of 6.25%. Have your employee or payee complete federal Form W-4 or Minnesota Form W-4MN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.