Loading

Get Mn M15np Additional Charge For Underpayment Of Estimated Tax 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the MN M15NP Additional Charge For Underpayment Of Estimated Tax online

Filling out the MN M15NP Additional Charge For Underpayment Of Estimated Tax form can seem overwhelming, but this guide aims to simplify the process for you. By following the provided steps, users can accurately complete the form and manage their tax responsibilities more effectively.

Follow the steps to accurately fill out the MN M15NP form online.

- Click ‘Get Form’ button to obtain the MN M15NP form and open it in your preferred digital editor.

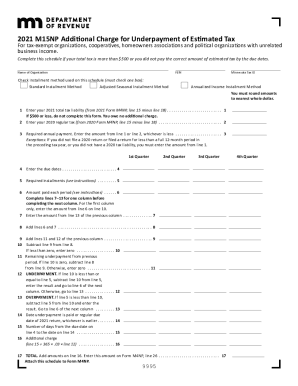

- In the form, begin by entering your organization's name, Federal Employer Identification Number (FEIN), and Minnesota Tax ID in the appropriate fields.

- Select the installment method you are using by checking one box among the Standard Installment Method, Adjusted Seasonal Installment Method, or Annualized Income Installment Method.

- Enter your total tax liability for 2021 from the specified line of the 2021 Form M4NP. If this amount is $500 or less, you do not need to complete the form.

- Record your 2020 regular tax as indicated, using the appropriate line from the 2020 Form M4NP.

- Calculate and input your required annual payment on line 3; choose either the lower amount from lines 1 or 2, unless exceptions apply.

- Fill out the due dates for each installment in line 4 based on your tax year.

- Complete the section for required installments on line 5, detailing the amount due.

- In line 6, report the amount paid for each period based on the instructions provided.

- Follow the instructions to enter amounts for lines 7-13 as you compute underpayment and overpayment for each quarter.

- Calculate the additional charge in line 16 by using the formula provided: (line 15 ÷ 365 × .03 × line 12).

- Finally, add the amounts in line 16 to get the total for line 17, which you will enter on Form M4NP, line 26.

- Once completed, save changes, download, print, or share the form as needed.

Take action now and complete your MN M15NP Additional Charge For Underpayment Of Estimated Tax form online.

Related links form

Penalty for underpayment of estimated tax Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.