Get La Ldr R-1203 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR R-1203 online

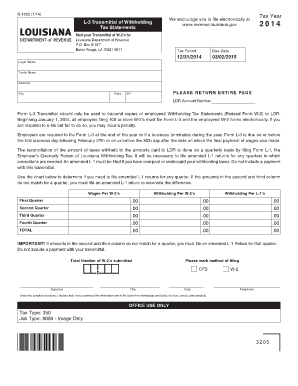

Filling out the LA LDR R-1203 form online is an essential step for employers in Louisiana who need to transmit their employees' withholding tax statements. This guide will provide you with clear instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the LA LDR R-1203 form online

- To obtain the form, press the ‘Get Form’ button to access the LA LDR R-1203 and open it in the online editor.

- Enter the tax year in which the withholding applies. For example, if you are submitting for 2023, select that year from the options provided.

- Fill in the legal name and trade name fields with the appropriate business names, ensuring accurate spelling and formatting.

- Complete the address information, including street address, city, state, and ZIP code. Make sure all details are correct to avoid processing delays.

- Input the LDR account number assigned to your business. This number is crucial for proper identification and processing of your submission.

- In the section regarding wages and withholding, enter the total amounts as reflected in your employees' W-2 forms. Ensure that the figures align with your records.

- Indicate the total number of W-2s submitted by checking the appropriate box. This will help the Louisiana Department of Revenue understand the volume of your filing.

- Provide your signature, title, and date at the designated fields. By signing, you are declaring that the information is true and correct to the best of your knowledge.

- Review all details entered for accuracy. Once confirmed, you can save your changes, download, or print a copy of the submitted form for your records.

Ensure your documents are complete and file the LA LDR R-1203 online for efficient processing.

Get form

Related links form

The military spouse Relief Act in Louisiana provides specific provisions to assist military spouses with income tax issues, particularly when they relocate due to military orders. Under this act, spouses may qualify for exemption from Louisiana income taxes by using the LA LDR R-1203 form. This legislation aims to ease the financial burden on military families during transfers or relocations. Familiarizing yourself with this act can help ensure you optimize your tax situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.