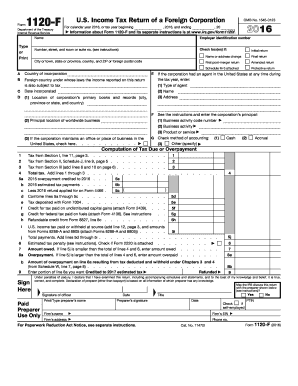

Get Irs 1120-f 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120-F online

How to fill out and sign IRS 1120-F online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When people aren’t linked to document management and legal operations, completing IRS documents can be rather overwhelming.

We understand the importance of accurately finalizing paperwork.

Utilizing our service will enable professional completion of IRS 1120-F. Make everything organized for your easy and swift work.

- Click on the button Get Form to open it and begin editing.

- Complete all necessary fields in the chosen document using our expert PDF editor. Activate the Wizard Tool to simplify the process even further.

- Ensure the accuracy of the entered information.

- Include the date of completing IRS 1120-F. Use the Sign Tool to create a unique signature for document validation.

- Conclude editing by clicking Done.

- Send this document directly to the IRS in the method most convenient for you: via email, digital fax, or postal service.

- You have the option to print it on paper if a hard copy is needed and to download or save it to your preferred cloud storage.

How to Alter Get IRS 1120-F 2016: Personalize Forms Online

Explore a singular service to manage all of your documentation effortlessly. Locate, alter, and complete your Get IRS 1120-F 2016 within one interface using advanced tools.

The times when individuals had to print forms or even handwrite them are over. Currently, all it requires to locate and complete any form, such as Get IRS 1120-F 2016, is to open a single browser window. Here, you will discover the Get IRS 1120-F 2016 form and tailor it in any manner you require, from entering the text directly in the document to sketching it on a digital sticky note and attaching it to the file. Uncover tools that will streamline your paperwork with minimal effort.

Hit the Get form button to prepare your Get IRS 1120-F 2016 documentation swiftly and start editing it immediately. In the editing mode, you can effortlessly fill the template with your information for submission. Simply click on the field you wish to modify and insert the data promptly. The editor's interface does not require any specialized skills to operate it. Once you have completed the edits, verify the information's correctness once more and sign the document. Click on the signature field and follow the prompts to eSign the form in a moment.

Utilize additional tools to personalize your form:

Preparing Get IRS 1120-F 2016 documentation will never be confusing again if you know where to locate the right template and complete it swiftly. Do not hesitate to give it a try yourself.

- Employ Cross, Check, or Circle tools to highlight the document's information.

- Insert text or fillable text boxes with text editing features.

- Remove, Highlight, or Blackout text segments in the document using appropriate tools.

- Add a date, initials, or even an image to the document if required.

- Make use of the Sticky note tool for annotations on the form.

- Utilize the Arrow and Line, or Draw tool to incorporate visual elements into your document.

Get form

Related links form

Failing to file the IRS 1120-F on time can lead to significant penalties and interest charges. The penalty is typically assessed based on the amount of tax owed and can increase with each month a return is late. Ignoring these filing requirements can also complicate the corporation's U.S. income tax obligations further down the road. To avoid these issues, using reliable services like UsLegalForms can help ensure timely compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.