Get Ut Ustc Tc-941r 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-941R online

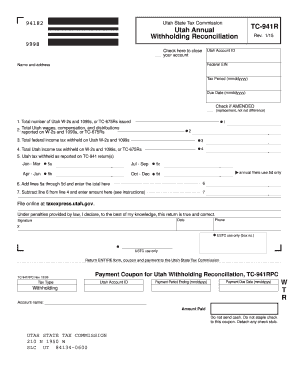

Filling out the UT USTC TC-941R form is an essential task for individuals and businesses needing to reconcile their Utah withholding tax. This guide provides step-by-step instructions to help users complete this form accurately and efficiently.

Follow the steps to fill out the UT USTC TC-941R online.

- Click the ‘Get Form’ button to access the form and open it in an online environment.

- Enter your Utah Account ID and Federal Employer Identification Number (EIN) in the designated fields.

- Provide your name and address as they should appear on the form.

- Input the tax period in the format mmddyyyy to specify the timeframe for the reconciliation.

- Indicate the due date for the submission of the form, also using the mmddyyyy format.

- Check the box if this form is an amended version, meaning you are replacing a previous submission.

- In section 1, record the total number of Utah W-2s and 1099s or TC-675Rs issued.

- In section 2, provide the total amount reported on those W-2s and 1099s, or TC-675Rs.

- Fill in section 3 with the total amount of federal income tax withheld on Utah W-2s and 1099s.

- In section 4, specify the total amount of Utah income tax withheld on your W-2s and 1099s or TC-675Rs.

- For sections 5a to 5d, enter the Utah tax withheld as reported in your quarterly TC-941 returns.

- Calculate the total of lines 5a through 5d and enter that amount in section 6.

- Subtract the total from line 6 from the amount on line 4 and enter the result in section 7.

- If you are amending this reconciliation, check the box for amended and make necessary adjustments.

- At the bottom of the form, provide your signature, date, and phone number to certify the accuracy of the submission.

- Once completed, save the changes, download the form, and utilize the options for printing or sharing as necessary.

Complete your UT USTC TC-941R form online today to ensure your Utah withholding tax is fully reconciled.

Related links form

To fill out the education tax credit, gather relevant information such as tuition costs and approved educational institutions. You will need to complete the appropriate tax forms related to education credits, which may vary based on the type of credit you are claiming. Using the UT USTC TC-941R can help ensure you receive the maximum benefit. Check eligibility requirements carefully to optimize your tax situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.