Loading

Get Ut Ustc Tc-941r 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-941R online

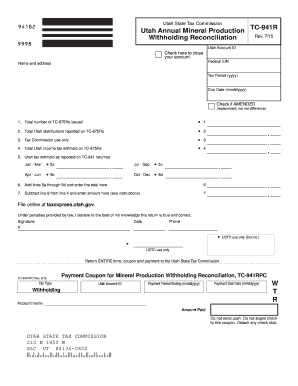

The UT USTC TC-941R form is essential for mineral producers in Utah to reconcile annual withholding taxes effectively. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the UT USTC TC-941R online

- Click ‘Get Form’ button to access the TC-941R and open it in the online editor.

- Enter your Utah Account ID in the designated field.

- Input your Federal EIN in the corresponding area.

- Fill in your name and address, ensuring all information is accurate and up-to-date.

- Specify the tax period using the correct year format (yyyy) and due date in the format (mmddyyyy).

- If applicable, check the box to indicate if this is an amended return.

- For line 1, record the total number of TC-675Rs issued during the year.

- On line 2, enter the total Utah distributions reported that correspond to the TC-675Rs.

- Leave line 3 blank as it is for Tax Commission use only.

- Input the total Utah income tax withheld on TC-675Rs in line 4.

- For lines 5a through 5d, report Utah tax withheld from each quarterly return: Jan - Mar on 5a, Apr - Jun on 5b, Jul - Sep on 5c, and Oct - Dec on 5d.

- Add up the amounts from lines 5a through 5d and enter the total on line 6.

- Subtract the total on line 6 from the total on line 4 and record this on line 7.

- If necessary, confirm any discrepancies by reviewing unbalanced reconciliations, as indicated in the instructions.

- Review the entire form for accuracy and completeness, then proceed to save changes, download, print, or share the completed form.

Complete your UT USTC TC-941R online for efficient tax reconciliation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To close a Utah withholding account, you must submit a request to the Utah State Tax Commission. This usually involves filling out the required forms and ensuring all tax liabilities are settled. It's advisable to keep the UT USTC TC-941R handy to reference any relevant information needed for your account closure.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.