Loading

Get Ut Ustc Tc-941 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-941 online

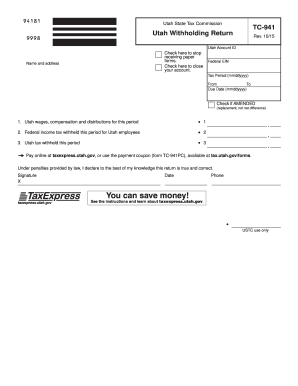

The UT USTC TC-941 is an essential document for reporting Utah withholding tax for employees. This guide provides clear steps to help users complete the form accurately online, ensuring compliance with tax regulations.

Follow the steps to fill out the UT USTC TC-941 online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter your Utah Account ID in the designated field. Ensure the ID is accurate to avoid any processing issues.

- Provide your Federal Employer Identification Number (EIN) in the appropriate section. This number is essential for tax reporting.

- Input the tax period for which you are reporting, using the mmddyyyy format for both the 'From' and 'To' fields.

- Fill in the due date for the form, again using the mmddyyyy format. This is critical for timely filing.

- If applicable, check the box indicating if this is an amended return. This informs the tax commission that the submitted form replaces a previous one.

- Complete line 1 by entering the total Utah wages, compensation, and distributions for the reporting period. Ensure all amounts are accurate and reflect payments made.

- On line 2, record the total federal income tax withheld for all employees noted in line 1. This amount is crucial for your tax return.

- For line 3, enter the total amount of Utah tax withheld during the specified period.

- Once completed, users can save their changes, download, print, or share the form as needed.

Complete your UT USTC TC-941 form online to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a Utah withholding number, visit the Utah State Tax Commission's website and complete the registration process. You will need to provide relevant information about your business to receive your withholding number. This number is essential for tax compliance and managing employee withholdings accurately. For a smoother experience, consider the resources available through US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.