Loading

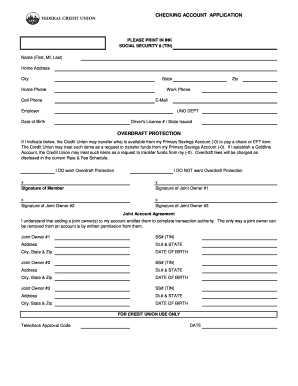

Get Checking Account Application Overdraft Protection - Unofcu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHECKING ACCOUNT APPLICATION OVERDRAFT PROTECTION - Unofcu online

Filling out the CHECKING ACCOUNT APPLICATION OVERDRAFT PROTECTION - Unofcu is a straightforward process that allows users to apply for overdraft protection on their checking account. This guide will provide step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully fill out the application.

- Press the ‘Get Form’ button to access the application form in your preferred editing tool.

- Complete the personal information section, which includes your Social Security number, full name (first, middle initial, last), home address, city, state, zip code, home phone, work phone, cell phone, email, employer name, department, date of birth, and driver's license number/state issued.

- Indicate your preference for overdraft protection by selecting either 'I DO want Overdraft Protection' or 'I DO NOT want Overdraft Protection.' By choosing to receive overdraft protection, you authorize the Credit Union to transfer available funds from your Primary Savings Account to cover checks or electronic funds transfer items.

- Sign the form as the member, and if applicable, have joint owners also provide their signatures. If there are joint owners, fill out their details, including their full name, Social Security number, address, driver's license number/state issued, city, state, zip, and date of birth for each joint owner.

- Review the completed application for any errors or omissions, ensuring all required fields are filled correctly.

- Once you are satisfied with the form, save your changes, and choose to download, print, or share the document as necessary.

Begin filling out your CHECKING ACCOUNT APPLICATION OVERDRAFT PROTECTION - Unofcu online today!

Though overdraft protection has benefits and can offer convenience, the potential fees involved may add up quickly. One way to steer clear of such fees is to simply not opt in for overdraft coverage. Your bank will just decline a debit card transaction if you lack sufficient funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.