Loading

Get 2013 Simplified Individual Tax Return For Rrsp Excess Contributions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Simplified Individual Tax Return for RRSP Excess Contributions online

Filling out the 2013 Simplified Individual Tax Return for RRSP Excess Contributions online can streamline your tax reporting process. This guide will provide you with step-by-step instructions to ensure that you accurately complete the necessary fields and sections.

Follow the steps to effectively complete your tax return.

- Use the ‘Get Form’ button to obtain the form and open it in the editor.

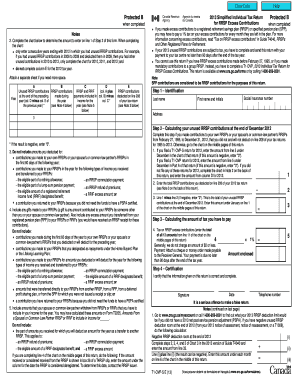

- Begin by providing your identification details. Enter your last name, first name and initials, social insurance number, and address in the designated fields.

- In Step 2, calculate your unused RRSP contributions as of December 2012. Follow the chart guidelines and ensure to only include consecutive years up to 2012 that had unused contributions. If amounts are negative, enter '0'.

- Proceed to Step 3, where you will determine the amount of tax you need to pay on excess contributions. Calculate the total from your previous entries and input this in the designated section.

- In Step 4, certify the accuracy of your information by signing the form and including the date and your telephone number. Ensure you understand the seriousness of providing accurate information.

- Finally, review your completed form. You can save changes, download, print, or share the form as necessary.

Start filling out your 2013 Simplified Individual Tax Return online today to ensure your RRSP contributions are accurately reported.

If your CRA My Account balance or notice of assessment shows that you have exceeded the limits and owe taxes on excess contributions to an RRSP, then resolving the situation involves filing a tax form and paying the penalty tax or asking the CRA for a waiver.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.