Loading

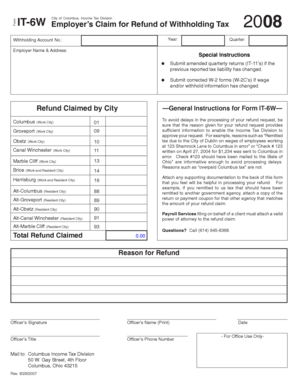

Get Form It-6w 2008 City Of Columbus, Income Tax Division Employer S Claim For Refund Of Withholding

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-6W 2008 City Of Columbus, Income Tax Division Employer S Claim For Refund Of Withholding online

Filling out the Form IT-6W for the City of Columbus can be an essential process for employers seeking a refund of withholding tax. This guide provides clear, step-by-step instructions to help you complete the form online, ensuring you provide all necessary information for successful submission.

Follow the steps to accurately complete your refund claim.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Enter the year for which you are claiming a refund in the 'Year' field.

- Fill in your withholding account number in the designated area. This is crucial for identifying your account.

- Provide the employer's name and address, ensuring all details are accurate to avoid processing delays.

- List all relevant work and resident cities associated with the employees in the respective sections provided. Ensure that you differentiate between work cities and resident cities.

- Indicate the total refund amount you are claiming in the 'Total Refund Claimed' section.

- Select the reason for your refund claim from the provided options. Be specific and include enough details to prevent any processing issues.

- If applicable, submit corrected W-2 forms (W-2C’s) for any changes in wage or withholding information.

- Attach any supporting documentation that may help process your refund, such as payment coupons or returns that clarify the refund claim.

- Have an authorized officer sign the form and provide their printed name, title, phone number, and the date.

- Review all entered information for accuracy before finalizing.

- Once completed, save the changes. You may also choose to download, print, or share the form as needed.

Complete your Form IT-6W online today to ensure a smooth refund process.

The minimum combined 2020 sales tax rate for Columbus, Ohio is 7.5%. This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The County sales tax rate is 1.25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.