Loading

Get Ap-228 Application For Texas Agriculture And Timber Exemption ... - Window State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AP-228 Application For Texas Agriculture And Timber Exemption online

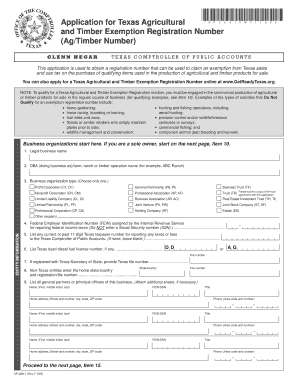

The AP-228 Application for Texas Agriculture and Timber Exemption is designed for individuals engaged in the commercial production of agricultural or timber products for sale. This guide provides clear, step-by-step instructions to help users fill out the application accurately online.

Follow the steps to fill out the AP-228 Application effectively.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by providing the legal business name in the designated field. If applicable, include the ‘doing business as’ (DBA) name for your farm, ranch, or timber operation in the next field.

- Select the type of business organization. This could be a profit corporation, general partnership, or other specified options from the list. Make sure to choose only one.

- Enter the Federal Employer Identification Number (FEIN) issued by the IRS. Do not enter a Social Security number (SSN) in this field.

- If you have a current or past 11-digit Texas taxpayer number, list it in the appropriate section. If not, leave this field blank.

- If you possess a Texas dyed diesel fuel license number, enter it in the specified area.

- For Texas entities, provide the Texas file number if registered with the Texas Secretary of State. For non-Texas entities, enter the home state or country along with the corresponding registration/file number.

- List all general partners or principal officers of the business, including their names, titles, and addresses. Make use of additional sheets if necessary.

- If you are a sole owner, provide your name in the next section, along with your address and, if applicable, your SSN or national ID number.

- Continue filling out the mailing address and physical location address. Ensure to differentiate between mailing and physical addresses, as a P.O. Box address should not be used for the physical location.

- Enter your email address and phone number for communication purposes.

- Check the box for the primary exempt activity that reflects your main business focus. Only select one option that best describes your primary business.

- The application must be signed by the sole owner, general partners, or authorized representatives. Attach a power of attorney if an authorized representative is signing.

- After signing, ensure the application is complete. You can submit the form in person at local offices or mail it to the Texas Comptroller of Public Accounts at the specified address.

- Finally, keep a copy of the application for your records. After submission, expect the permit within three to four weeks, unless there are issues with the application.

Complete your application for Texas Agriculture and Timber Exemption online for a streamlined process.

Yes. Persons who breed and sell horses in the regular course of business (including standing studs or using live cover, shipped semen or artificial insemination) qualify for an ag/timber number. Equipment used exclusively on the farm or ranch to produce horses for sale can be purchased tax free.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.