Loading

Get Pa Pa-8879p 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PA-8879P online

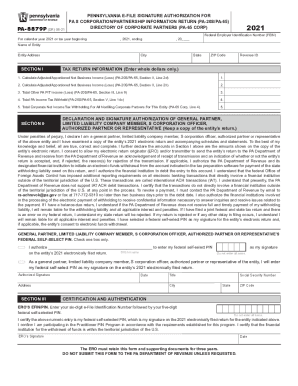

The PA PA-8879P is a critical form for Pennsylvania entities, including partnerships and S corporations, allowing authorized representatives to electronically sign tax returns. This guide provides a clear, step-by-step approach for completing the form online.

Follow the steps to fill out the PA PA-8879P effectively.

- Press the ‘Get Form’ button to access the PA PA-8879P form and open it for editing.

- Fill in the calendar year and the entity’s Federal Employer Identification Number (FEIN) at the top of the form.

- Enter the name of the entity in the designated field along with the full address, including city, state, and ZIP code.

- In Section I, provide tax return information by entering all required amounts in whole dollars. Ensure accuracy, reflecting data from the entity’s tax return.

- Proceed to Section II and have the authorized representative verify the entity's tax return and consent to the electronic submission by checking the appropriate box.

- Enter the federal self-select PIN, which must be five numbers other than all zeros, either by authorization or entry by the representative.

- The authorized representative must sign, date the form in Section II, and include their title.

- Return the completed PA PA-8879P to the electronic return originator (ERO) using hand delivery, mail, or another secure method for further processing.

- As your final step, save changes made to the form, then download, print, or share it as needed while ensuring you keep a copy for your records.

Complete your PA PA-8879P online today for a smoother filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An Electronic Return Originator (ERO) begins the process of electronic submission of returns it either prepares or collects from taxpayers who want to e-file their returns. An ERO starts the electronic submission of a return after the taxpayer authorizes the filing of the return via IRS e-file.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.