Loading

Get 401k Catch Up Contribution Election Form - Instant Benefits

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401k Catch Up Contribution Election Form - Instant Benefits online

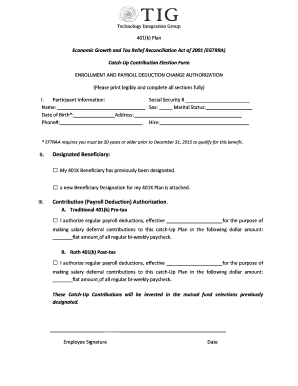

The 401k Catch Up Contribution Election Form - Instant Benefits is a crucial document for individuals aged 50 and older looking to maximize their retirement savings. This guide will provide you with clear, step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete your form online meticulously.

- Press the ‘Get Form’ button to obtain the 401k Catch Up Contribution Election Form - Instant Benefits and open it in your preferred document editor.

- Begin by filling out the Participant Information section. Start with your Social Security number, followed by your full name, sex, and marital status. Next, enter your date of birth, address, and phone number. Ensure that all entries are clear and legible.

- In the Designated Beneficiary section, indicate whether your 401k Beneficiary has previously been designated or if you are attaching a new Beneficiary Designation.

- Move on to the Contribution (Payroll Deduction) Authorization section. Decide if you wish to authorize regular payroll deductions for either the Traditional 401(k) Pre-tax or Roth 401(k) Post-tax options. Mark your choice accordingly.

- For the selected option, input the effective date for the payroll deductions and specify the dollar amount to be deducted from each regular bi-weekly paycheck. Make sure your selected amount aligns with your savings goals.

- Finally, provide your signature and date at the bottom of the form. This confirms your authorization for the contributions as specified.

- Once completed, you can save the changes made to the form, download it for your records, or print it for submission. Ensure you keep a copy for your personal files.

Start filling out the 401k Catch Up Contribution Election Form online today!

If permitted by the 401(k) plan, participants age 50 or over at the end of the calendar year can also make catch-up contributions. You may contribute additional elective salary deferrals of: $6,500 in 2021 and 2020 and $6,000 in 2019 - 2015 to traditional and safe harbor 401(k) plans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.