Loading

Get 10f India Example Completed Form 10f

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 10f India Example Completed Form 10f online

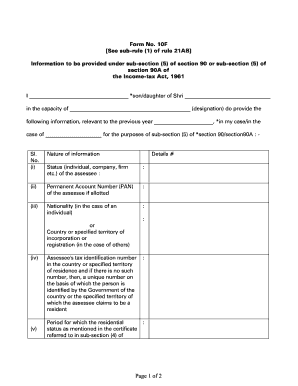

Filling out the 10F form is an essential part of ensuring compliance with the Income-tax Act, 1961, for individuals and entities seeking to claim benefits under Double Taxation Avoidance Agreements. This guide offers clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the 10F form online.

- Press the ‘Get Form’ button to access the 10F form and open it for editing.

- In the first section, enter your full name and mention whether you are the son or daughter of the specified individual. Provide your designation in the next field.

- Indicate the previous financial year that pertains to your case in the required field.

- For the nature of information, enter the relevant details of your status, such as individual, company, or firm.

- Fill in your Permanent Account Number (PAN) if you have been allotted one. If you do not have a PAN, indicate as such.

- Specify your nationality if you are an individual. For companies or firms, mention the country or specified territory of incorporation or registration.

- Provide your tax identification number in your country of residence. If no such number exists, supply a unique identification number recognized by your government.

- Indicate the period for which your residential status is applicable based on the certificate from subsection (4) of section 90 or 90A.

- Enter your address outside India for the duration specified in the previous section.

- State the name of the country or territory from which you received the necessary certificate as referenced earlier in the form.

- Affix your signature, write your name, and include your address along with your PAN at the bottom of the form.

- Lastly, provide your declaration by entering the date of verification and your signature again.

- After completing the form, ensure you save your changes. You can also download, print, or share the form as needed.

Complete your documents online today and ensure your compliance!

Provide your residency and tax identification information. ... Print and sign your form. ... File your form with your tax return. ... Maintain documentation of the information provided.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.