Loading

Get Ne Form 12n 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 12N online

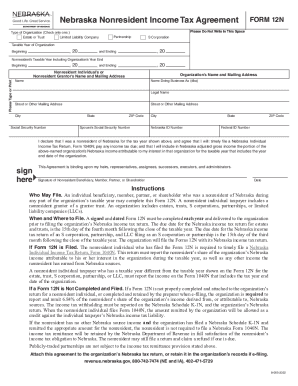

Filling out the NE Form 12N is an essential process for nonresident individuals who need to report their income associated with an organization in Nebraska. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the NE Form 12N online.

- Click ‘Get Form’ button to receive the NE Form 12N and open it for editing.

- Indicate the type of organization by checking the appropriate box: Estate or Trust, Limited Liability Company, Partnership, or S Corporation.

- Enter the taxable year of the organization, including the beginning and ending dates.

- Input the nonresident individual’s or grantor’s name, including their mailing address. Be sure to fill in the organization’s name and address as well.

- Provide relevant identification numbers, including the Social Security Number and Nebraska ID Number, for both the nonresident and, if applicable, their spouse.

- Read and acknowledge the declaration regarding nonresidency in Nebraska and the obligations related to tax filing.

- Affix the signature of the nonresident beneficiary, member, partner, or shareholder along with the date of signing.

- Review all entered information for accuracy and completeness before finalizing the submission.

- Once completed, save changes to the form. You can download, print, or share the form as needed.

Complete your documents online to ensure timely compliance with Nebraska tax regulations.

Only use Form 1040XN to file an amended return. 4. If you filed your original return using an Individual Taxpayer Identification Number (ITIN), and you are now filing an amended return with a valid SSN, include the ITIN in your explanation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.