Loading

Get Ne Form 10 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 10 online

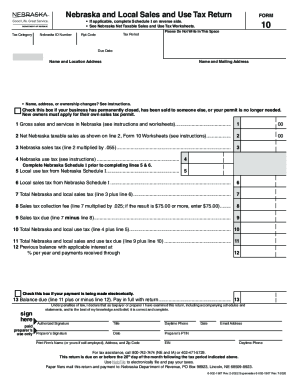

Filing the Nebraska and Local Sales and Use Tax Return using NE Form 10 can be straightforward when you have clear guidance. This guide will walk you through each section and field of the form, ensuring that you can complete it online with confidence.

Follow the steps to fill out NE Form 10 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Nebraska ID number. This unique identifier allows you to file your tax return accurately.

- Specify the tax period of the return. For this form, use the period from July 1, 2021, to March 31, 2022.

- Provide your business name and location address in the designated fields, ensuring accuracy.

- Complete the 'Gross sales and services in Nebraska' line by entering the total dollar amount of sales you made in the state.

- Calculate your 'Net Nebraska taxable sales' using the Nebraska Net Taxable Sales worksheet, and enter the result.

- Determine the 'Nebraska sales tax' amount by multiplying your net taxable sales by the applicable tax rate (0.055).

- Calculate the 'Nebraska use tax' as detailed in the instructions if applicable.

- Complete lines for local sales and use tax, entering the amounts according to your sales within local jurisdictions.

- Summarize the total Nebraska and local sales and use tax due by performing necessary calculations based on the previous lines.

- Sign and date the form, affirming that the entries are correct to the best of your knowledge.

- Before finishing, check all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Start filling out your NE Form 10 online today to ensure timely submission and compliance with Nebraska tax regulations.

A claim for refund of sales and use tax paid on qualifying purchases is to be filed on Form E-585.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.