Loading

Get Co Dr 1102 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 1102 online

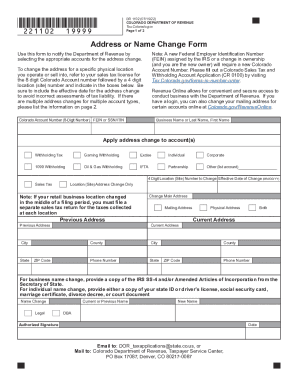

The CO DR 1102 form is an essential document used to notify the Colorado Department of Revenue about changes to addresses or names associated with various tax accounts. This guide provides clear instructions to facilitate the online completion of this form, ensuring a smooth process for all users.

Follow the steps to successfully complete the CO DR 1102 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering your Colorado Account Number, which consists of an 8-digit number, followed by your Federal Employer Identification Number (FEIN) or Social Security Number (SSN)/Individual Taxpayer Identification Number (ITIN). This identifies your account.

- Provide your business name or last name followed by your first name to ensure accurate identification.

- Select the accounts for which you are applying the address change by checking the relevant boxes: Withholding Tax, Gaming Withholding, Excise, Individual, Corporate, 1099 Withholding, Oil & Gas Withholding, IFTA, Partnership, or other (if applicable).

- If changing the address for a specific location, include the 4-digit location (site) number associated with your sales tax license. Specify the effective date of the address change in MM/DD/YY format to prevent incorrect tax liability assessments.

- Fill in your previous address details, including street address, city, state, county, ZIP code, and phone number.

- Next, enter your current or new mailing address. Make sure to include all fields such as street address, city, state, county, ZIP code, and phone number.

- If you are changing your name, indicate your current or previous name and your new name. If applicable, provide the Doing Business As (DBA) name.

- Sign, date, and provide your email address for any further communication regarding your application.

- Once you have completed the form, review all information for accuracy, then save your changes. You can choose to download, print, or share the completed form as needed.

Complete your documents online for a quick and efficient filing process.

What is form DR 0004? Form DR 0004 is the new Colorado Employee Withholding Certificate that is available for 2022. It is not meant to completely replace IRS form W-4 for Colorado withholding, but to help employees in a few specific situations fine-tune their Colorado withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.