Loading

Get Itr-dd - Confirmation Of Diagnosis Of Disability - Sars

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the ITR-DD - Confirmation Of Diagnosis Of Disability - Sars online

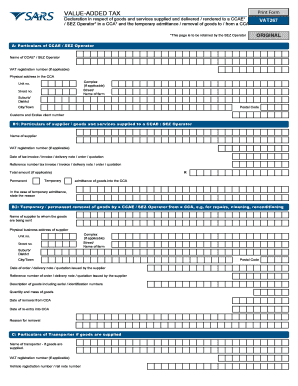

Filling out the ITR-DD form is essential for confirming a diagnosis of disability for tax purposes. This guide offers step-by-step instructions to help individuals accurately complete the form online.

Follow the steps to successfully complete your ITR-DD form.

- Press the ‘Get Form’ button to access the ITR-DD form and open it in your editing environment.

- Complete section A by providing your personal details, including your name, identification number, and contact information.

- Move to section B, where you will enter details regarding the diagnosis. This includes the condition diagnosed and any relevant supporting documentation.

- In section C, ensure that you provide additional details required for confirming your disability, such as medical practitioner information.

- Proceed to section D, where you affirm that all information provided is truthful and accurate. Sign and date this section.

- Once the form is fully completed, you will have the option to save the changes, download, print, or share the form as needed.

Complete your ITR-DD form online today for a smoother submission process.

Related links form

When completing the income tax return, either the person with the disability (if they have taxable income to be reduced to zero) or the supporting person can claim the credit. If the person with the disability is claiming the credit, it is recorded on line 316 of the Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.