Loading

Get Mo W-4 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO W-4 online

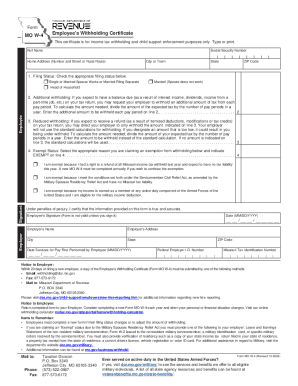

The MO W-4 form, also known as the Employee's Withholding Certificate, is essential for managing income tax withholding and ensuring compliance with tax obligations. This guide provides a clear, step-by-step approach to help users navigate the process of completing this form online.

Follow the steps to successfully complete your MO W-4 online.

- Click 'Get Form' button to access the MO W-4 form and open it in your preferred online editor.

- Begin by entering your full name in the designated field, ensuring that it matches the name on your Social Security card.

- Input your Social Security Number in the appropriate field. This number is crucial for tax identification purposes.

- Provide your home address, including the street number and name or rural route, city or town, state, and ZIP code.

- Select your filing status by checking the box that applies to your situation: 'Single or Married Spouse Works,' 'Married (Spouse does not work),' or 'Head of Household.'

- If you anticipate owing additional taxes due to other income sources, such as interest or dividends, enter the extra amount you wish to be withheld from each pay period on line 2.

- If you expect a tax refund based on deductions or credits, indicate the reduced withholding amount on line 3 to avoid excess withholding.

- For exempt status, select the appropriate reason for claiming exemption from withholding and clearly indicate 'EXEMPT' on line 4.

- Affix your signature in the designated section and include the date to validate your form. Note that the form is not valid without your signature.

- Finally, review all entered information for accuracy before saving your changes. You can then download, print, or share the completed form with your employer.

Take action now to complete your MO W-4 online and ensure your tax withholdings are accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer. Enter the business name, federal employer identification number (FEIN), and address in the “Employer use only” section of Form OR-W- 4.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.