Loading

Get Irs 4720 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4720 online

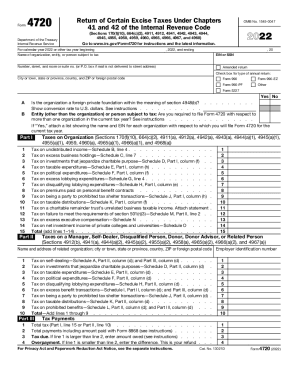

The IRS 4720 is an essential form used to report certain excise taxes under various chapters of the Internal Revenue Code. Understanding how to accurately fill out this form is crucial for organizations and individuals subject to these tax obligations.

Follow the steps to expertly complete the IRS 4720 online.

- Press the ‘Get Form’ button to access the IRS 4720 form and open it in a digital editor.

- Begin by entering the name of the organization, entity, or person subject to tax in the designated field. Ensure that this information is accurate and matches the official records.

- Input the Employer Identification Number (EIN) or Social Security Number (SSN) for tax identification purposes. This is a critical field that links the form to the correct taxpayer.

- Fill in the address details including number, street, suite number, city or town, state, and postal code.

- If applicable, check the box to indicate whether you are filing an amended return. This is important for clarity in processing your form.

- Select the type of annual return being filed, such as Form 990, Form 990-EZ, Form 990-PF, or others, by checking the appropriate boxes.

- Answer whether the organization is classified as a foreign private foundation. This impacts tax responsibilities and compliance requirements.

- Complete Part I, which addresses taxes on the organization. You will need to report different types of taxes based on the schedules applicable to your organization’s activities.

- Proceed to Part II for taxes related to managers, self-dealers, and disqualified persons. Ensure that detailed information is provided for each instance of taxable activities.

- In Part III, summarize all tax payments, including the total tax due and any overpayments, if applicable. This section is crucial for determining your final balance.

- After completing all sections, review the form for accuracy and completeness. Add any necessary attachments that support your entries.

- Save your changes, and choose to download, print, or share the form based on your filing needs.

Complete your IRS 4720 form online today to ensure compliance with tax obligations.

Filing a Complaint They can be sent via: Mail to IRS EO Classification, Mail Code 4910DAL, 1100 Commerce St., Dallas, TX 75242-1198, Fax to 514-413-5415, Email to eoclass@irs.gov, or • Telephone by calling the TE/GE toll-free number: 877-829-5500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.