Loading

Get Irs 1040-es 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-ES online

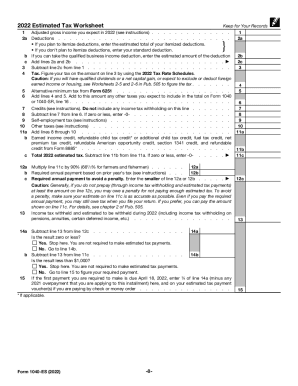

Filling out the IRS 1040-ES is essential for individuals who need to calculate and pay their estimated taxes. This guide provides clear, step-by-step instructions to assist users in completing the form online, ensuring accuracy and compliance with tax regulations.

Follow the steps to fill out the form accurately:

- Press the ‘Get Form’ button to download the IRS 1040-ES. This will allow you to access the digital version of the form for editing.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number. Ensure that all details are entered correctly.

- Calculate your estimated gross income for 2022. This estimate should include income from all sources that are not subject to withholding taxes.

- Calculate your expected deductions, choosing between itemized deductions or the standard deduction based on your eligibility.

- Use the provided Tax Rate Schedules to determine your estimated taxable income and calculate the estimated tax amount owed.

- Review and include any additional taxes that may apply to your situation, such as self-employment tax or any applicable penalties.

- Calculate your total estimated tax due by subtracting any credits from your total tax liability.

- Specify the amount of estimated tax payment you are submitting for each quarter. Ensure the payment dates are noted and adhered to.

- Review all entries for accuracy before finalizing. Make sure that your calculations are correct to avoid penalties.

- Once complete, save the changes to your form. You may then choose to download, print, or share the form as needed.

Complete your IRS 1040-ES online today to ensure timely and accurate tax payments.

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.