Loading

Get Irs Instruction 1045 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1045 online

Filling out the IRS Instruction 1045 online can be straightforward with the right guidance. This document assists individuals, estates, and trusts in applying for a tentative refund based on specific tax situations, such as net operating losses and unused credits.

Follow the steps to fill out the IRS Instruction 1045 online.

- Click the ‘Get Form’ button to access the form and open it in your chosen editor.

- Fill in your personal information at the top of the form, ensuring accuracy in your name, address, and social security number.

- Proceed to line 1 to identify the type of refund you are applying for, selecting the appropriate box based on your situation.

- If you are claiming an unused general business credit, refer to line 1b. Attach a detailed computation to support your claim.

- For net section 1256 contracts loss claims, complete line 1c. Ensure you attach all necessary supporting documents, including Form 6781.

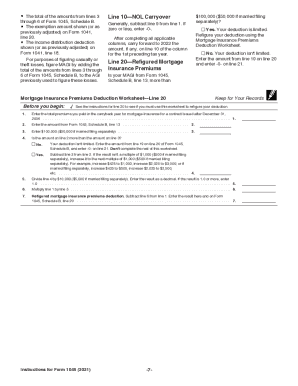

- Continue to lines 10 through 32 to compute the decrease in tax for each carryback year, entering required information as prompted.

- On Schedule A, calculate and detail the amount of net operating loss (NOL) available for carryback or carryforward.

- Complete Schedule B to ascertain the NOL deduction for each applicable carryback year, ensuring all information is correctly documented.

- Review the completed form for accuracy and ensure all required schedules and attachments are included.

- Once finalized, save your changes, download a copy for your records, or print the form for submission.

Start filing your IRS Instruction 1045 online today for a quick refund.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A tax return including Form 1045 cannot be filed electronically. If there is any uncertainty about interpretation of an entry, UltimateTax does not calculate it. net section 1256 contracts loss.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.