Loading

Get Ca Std.236 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA STD.236 online

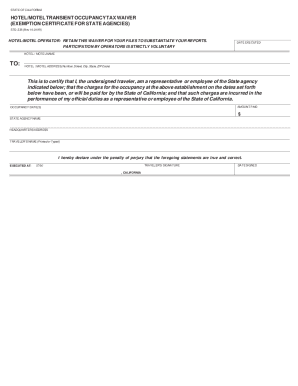

The CA STD.236 is a form used for the hotel/motel transient occupancy tax waiver, which serves as an exemption certificate for State agencies. This guide will provide step-by-step instructions on how to complete the form online with clarity and support.

Follow the steps to effectively complete the CA STD.236 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date executed in the designated field to specify when the waiver is completed.

- In the hotel/motel name section, provide the full name of the establishment where the stay occurred.

- Fill in the hotel/motel address including the number, street, city, state, and ZIP code.

- Indicate the occupancy date(s) during which the services were provided.

- Record the amount paid for the occupancy, ensuring to use the proper format for currency.

- Write the name of the state agency in the state agency name section.

- Include the headquarters address of the state agency, which should have the complete address format.

- Print or type the name of the traveler who is claiming the exemption.

- Include the city where the declaration is executed and ensure the traveler signed the document.

- Finally, enter the date signed to indicate when the waiver was completed.

- Once all required sections are filled, you can save changes, download the form, print it out, or share it as needed.

Complete your CA STD.236 online today for a seamless filing experience.

Related links form

Accommodations paid for with IBA cards are only exempt from state taxes in the following states: Delaware, Florida, Kansas, Louisiana, Massachusetts, New York, Oregon, Pennsylvania, Texas, Washington, and Wisconsin.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.