Loading

Get Sc Dor Sc4506 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC4506 online

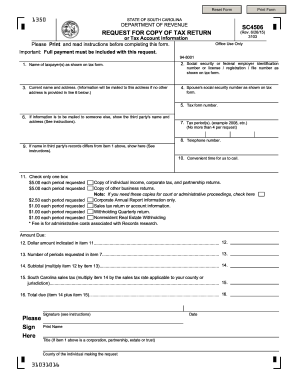

Filling out the SC DoR SC4506 form for requesting a copy of tax returns or account information can be straightforward with the right guidance. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the SC DoR SC4506 form online

- Click the ‘Get Form’ button to obtain the SC4506 form and open it in your document editor.

- In line 1, enter the name of the taxpayer(s) as it appears on the tax form. This ensures that the records correspond to the correct individual or entity.

- For line 2, enter the social security number for individuals or the federal employer identification number for businesses. The format for social security numbers should be 000-00-0000.

- Fill out line 3 with your current name and address. This is where all correspondence will be sent unless otherwise specified.

- If applicable, provide the spouse's social security number in line 4. This is required if the tax form is a joint return.

- Specify the tax form number in line 5 that you are requesting information for.

- In line 6, if you want the information sent to a third party, enter their name and mailing address.

- For line 7, indicate the tax period(s) you are requesting. You may list a maximum of four periods per request.

- Provide your telephone number in line 8 so that the department can reach you if additional information is needed.

- If the name associated with the third party's records differs from the name given in line 1, enter that name in line 9.

- Indicate a convenient time for the department to call you in line 10, if necessary.

- In line 11, check the appropriate box for the type of documents you are requesting. Fees vary based on the type and number of periods requested.

- Line 12 requests the dollar amount related to the fees per the selections in line 11.

- In line 13, enter the total number of periods you are requesting.

- Calculate the subtotal in line 14 by multiplying line 12 by line 13.

- Calculate the applicable South Carolina sales tax in line 15 and total everything in line 16.

- Sign and date the form in the designated area. If you are signing on behalf of a corporation, ensure to indicate your title.

- Once the form is complete, save your changes. You can then download, print, or share the completed form as required.

Submit your SC DoR SC4506 form online today for prompt processing of your tax records.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, South Carolina allows electronic filing (eFile) of tax returns. This user-friendly method simplifies the submission process and reduces the likelihood of errors. Following the SC DoR SC4506 guidelines ensures that you're completing the eFile forms accurately. For those requiring assistance, the uslegalforms platform offers resources to help you navigate eFiling seamlessly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.