Loading

Get Ar Dor Ar4 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DoR AR4 online

Filling out the AR DoR AR4 online can seem daunting, but with a clear step-by-step guide, it becomes manageable. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully complete the AR DoR AR4 form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the primary's social security number in the designated field. This number is essential for identifying the taxpayer.

- Fill in the primary's legal name as it appears on official documents. Accuracy is important to avoid processing issues.

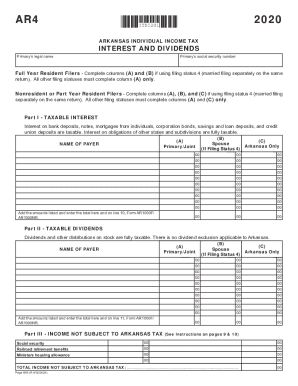

- Determine your filing status: If you are a full-year resident, complete columns (A) and (B). If you are a nonresident or part-year resident, complete columns (A), (B), and (C). Follow the instructions regarding filing separately if married.

- For Part I - Taxable Interest, list the name of the payer and enter the interest amounts in column (A), and if applicable, in (B) for the spouse. Sum the amounts and enter the total on line 10 of Form AR1000F/AR1000NR.

- In Part II - Taxable Dividends, similarly, list the name of the payer for dividends received and add the amounts in column (A). Enter the total on line 11 of Form AR1000F/AR1000NR.

- For Part III - Income Not Subject to Arkansas Tax, record amounts for items like Social Security and retirement benefits. Ensure to reference any relevant pages in the instructions for clarity.

- Review all entries for accuracy and completeness. Make sure all totals reflect the correct amounts.

- Once you have filled out the form, save changes, download for your records, or print and share if necessary.

Complete the AR DoR AR4 online today to ensure your filings are accurate and timely.

This credit, meant to help working parents pay care expenses for children and other dependents, went up to a maximum of $8,000 in 2021. For 2022, the maximum is back down to $1,050 for one qualifying person and $2,100 for two or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.