Get Lacdmh Revenue Management Division Umdap Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lacdmh Revenue Management Division Umdap Form online

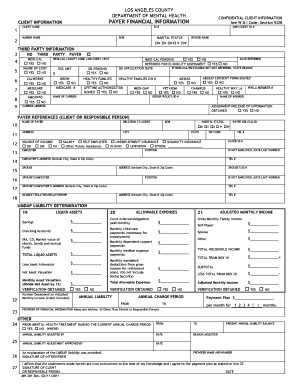

Filling out the Lacdmh Revenue Management Division Umdap Form is an essential step in determining a client's financial capability to pay for mental health services. This guide provides clear instructions for users to complete the form accurately and efficiently, ensuring compliance with regulatory requirements.

Follow the steps to complete the Umdap form online.

- Press the ‘Get Form’ button to access the Umdap Form and open it within the editing tool.

- Fill in the client information section. Enter the client's full name, Social Security number, maiden name, DMH client ID, marital status, and date of birth.

- Provide third-party information. Indicate if the client has Medi-Cal and if there is a share of cost. Specify other relevant details regarding eligibility and insurance.

- Complete the payer references section. Input information about the payer including name, relationship to client, date of birth, marital status, and address.

- Document the source of income for the client and their spouse, specifying amounts for each category, such as salary or public assistance.

- Calculate liquid assets by listing savings, checking accounts, and other investments. Deduct asset allowances to determine the net asset valuation.

- Complete allowable expenses, entering monthly obligations such as child care and medical expenses.

- Calculate adjusted monthly income by summing up monthly family income and subtracting allowable expenses to determine total household income.

- Provide the annual liability details, including the payment plan amount and duration.

- Have the client or responsible person sign the form, affirming the accuracy of the information provided.

- Save the completed form, and choose to download, print, or share it as necessary.

Start filling out your Umdap Form online today to ensure timely processing and accurate compliance.

Related links form

To apply for the IRS hardship program, you typically need to submit a 433F form along with supporting documents that outline your financial situation. This process allows you to establish your eligibility for tax relief options. The Lacdmh Revenue Management Division can provide resources to guide you in your application, ensuring that you complete it effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.