Loading

Get Mo Dor Mo-scc 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-SCC online

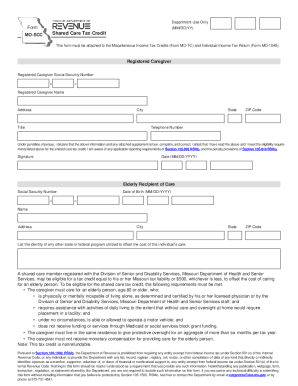

Filling out the MO DoR MO-SCC form online can be an essential step in applying for the shared care tax credit. This guide provides clear and detailed instructions to help you navigate the various sections of the form effectively.

Follow the steps to successfully complete the MO DoR MO-SCC online.

- Click the 'Get Form' button to obtain the MO-SCC document and access it in the online editor.

- Begin by entering the registered caregiver's Social Security number in the designated field. Ensure that you format the number correctly.

- Fill in the registered caregiver's full name and address, including the city, state, and ZIP code.

- Provide a valid telephone number for the registered caregiver. This contact information will be critical for any correspondence.

- In the section about the elderly recipient of care, enter their date of birth and Social Security number, again ensuring correct formatting.

- Complete the elderly recipient's name and address details, similar to the caregiver section, including city, state, and ZIP code.

- List any other state or federal programs that the elderly recipient utilizes to offset the cost of their care.

- Ensure to attach any necessary certifications, like the physician's certification or the Missouri Department of Health and Senior Services certification, if applicable.

- Read the declaration statement, confirming that the information provided is true and that you meet the shared care tax credit eligibility requirements.

- Finally, sign and date the form in the specified areas, ensuring that the date is in MM/DD/YYYY format.

- Review the completed form for accuracy and completeness before saving your changes, downloading, printing, or sharing the form as needed.

Complete your MO DoR MO-SCC form online today and take the first step toward accessing your shared care tax credit.

A 5 percent addition to tax penalty will apply if the tax is not paid by the original due date, provided your return is filed by the extension due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.