Loading

Get Mo Dor Mo-pts 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-PTS online

This guide provides clear instructions on how to complete the MO DoR MO-PTS form online. Whether you are a first-time user or someone familiar with digital document management, you will find the step-by-step guidance easy to follow.

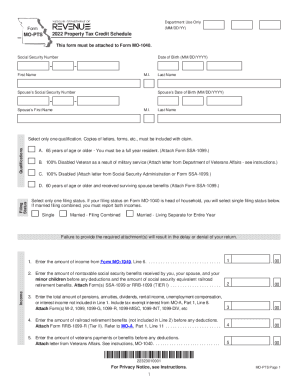

Follow the steps to complete the MO-PTS form accurately.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

- Enter your social security number and date of birth in the designated fields.

- Fill in your first name, middle initial, and last name as required.

- If applicable, provide your spouse’s social security number, date of birth, first name, middle initial, and last name.

- Select one qualification from the list provided (A-D) and attach the appropriate documentation as instructed.

- Choose your filing status from the options available: Single, Married - Filing Combined, or Married - Living Separate for Entire Year.

- Complete Lines 1 through 8 with the required income information. Make sure to attach any necessary forms like the W-2 or 1099.

- For property tax paid, enter the amount in Line 10 and attach the receipt. If you were renting, enter the amount from Certification of Rent Paid in Line 12.

- Calculate the total and complete Line 13, ensuring you understand the limits based on your circumstances.

- Follow the instructions given in the form to apply your results to determine your Property Tax Credit, which should be entered on Form MO-1040.

- Review your completed form for accuracy, then save your changes. You can download, print, or share the document as needed.

Start filling out your MO DoR MO-PTS form online today for a hassle-free experience.

Related links form

Proposal in Missouri General Assembly eliminates property taxes on older vehicles. CAMDENTON, Mo. (KY3) - A proposal in the Missouri legislature eliminates the personal property tax on vehicles older than ten years. Republican State Senator Bill Eigel filed the bill.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.