Loading

Get Irs Instructions 941 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 941 online

This guide provides clear, step-by-step instructions to assist users in filling out the IRS Instructions 941 online. Whether you are new to tax compliance or have some experience, this guide aims to make the process straightforward.

Follow the steps to complete your IRS Instructions 941 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter your employer identification number (EIN), name, and address accurately in the designated fields at the top of the form.

- Check the appropriate box under 'Report for this Quarter of 2022' to indicate the quarter for which you are filing.

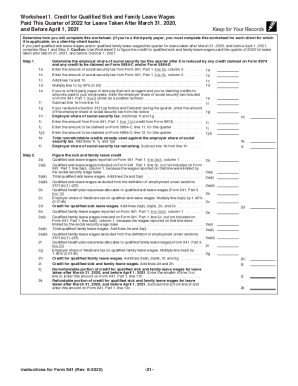

- In Part 1, answer the questions regarding the number of employees and total wages paid during the quarter.

- Provide details on wages, tips, and other compensation in Part 2. Ensure to include all relevant amounts that were subject to federal income tax withholding and social security tax.

- Complete Part 3 to share information regarding your deposit schedule and tax liabilities. Be sure to accurately report your total tax liability based on your payroll and other compensations.

- If applicable, complete Part 4 by indicating whether a third-party designee may discuss your Form 941 with the IRS.

- Sign and date the return in Part 5 to certify the accuracy of the information provided.

- Once completed, review the form for accuracy, then save, download, print, or share your completed Form 941 as necessary.

Complete your IRS Instructions 941 online today to ensure timely and accurate submission.

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.