Loading

Get Mo Dor Mo-nri 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-NRI online

Completing the MO DoR MO-NRI form online can be a straightforward process with the right guidance. This document outlines the essential steps to fill out this form accurately, ensuring compliance with Missouri's tax regulations.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the MO DoR MO-NRI form and open it for editing.

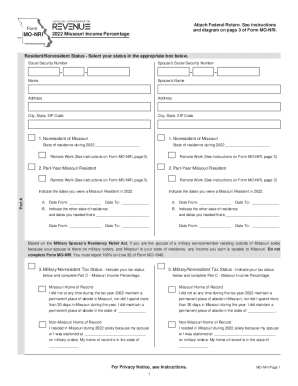

- Indicate your resident status by selecting the appropriate box for either Nonresident of Missouri, Part-Year Missouri Resident, or Military Nonresident Tax Status.

- Fill in your Social Security Number and your partner's Social Security Number, if applicable.

- Provide your name and your partner's name, followed by your address, including city, state, and ZIP code.

- If you are a Nonresident or Part-Year Resident, specify your state of residence during the year 2022 and check the Remote Work box if applicable.

- For Part A, complete the dates you were a Missouri resident during 2022, including the date range and the other state of residence, if applicable.

- Proceed to Part B and use the worksheet to list Missouri source income as well as any necessary income adjustments.

- In Part C, calculate your Missouri income percentage by entering the necessary figures and performing the required calculations.

- Once all sections are filled out, review your entries for accuracy before finalizing.

- Save changes, and choose to download, print, or share your completed MO DoR MO-NRI form as necessary.

Start filling out your MO DoR MO-NRI form online today!

If you are required to file a federal return, you may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income; You are a nonresident with less than $600 of Missouri income; OR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.