Loading

Get Va Dot R-1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT R-1 online

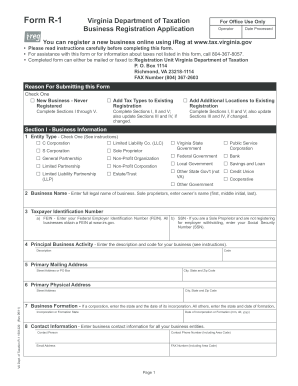

The Virginia Department of Taxation's Business Registration Application, known as Form R-1, is essential for individuals and businesses looking to register a new business or update an existing registration. This guide provides a clear and supportive approach to completing the form online, ensuring you have all the necessary information at your fingertips.

Follow the steps to complete the VA DoT R-1 online application.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin filling out Section I for Business Information. Select the appropriate entity type for your business by checking one of the boxes. This includes options like C Corporation, LLC, Sole Proprietor, or others. Ensure you provide the full legal name of the business and enter your Taxpayer Identification Number.

- In Section II, indicate the tax types you wish to register for. For example, if you need to register for Sales and Use Tax, check the relevant box and select your preferred filing options, such as filing a combined return or separate returns for each business location.

- Continue to Section III, which requires you to enter information about responsible parties, such as corporate officers or partners. Include their names, Social Security Numbers, contact information, and addresses for each responsible party.

- Proceed to Section IV to determine if your business is required to pay by Electronic Funds Transfer (EFT) based on your tax liabilities. Check the applicable tax types if your average monthly liability exceeds $20,000.

- Finally, review Section V, which includes the signature requirement. The form must be signed by an authorized officer of the business. Ensure all information is accurate before signing and dating the form.

- Once you have completed all sections, you can save the changes, download, print, or share the form as needed.

Complete your VA DoT R-1 form online today for a smooth business registration process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can fill out VA form 21 674 online through various platforms that facilitate electronic submissions. This option is convenient and helps ensure that your application is processed more quickly. Use the VA DoT R-1 for guidance on this form and other related procedures.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.